Kicking off with AGL Share Price History: What Investors Can Learn, this opening paragraph is designed to captivate and engage the readers, providing an interesting overview of AGL's historical share price performance, key milestones, influential events, and patterns or trends observed over time.

AGL Share Price History Overview

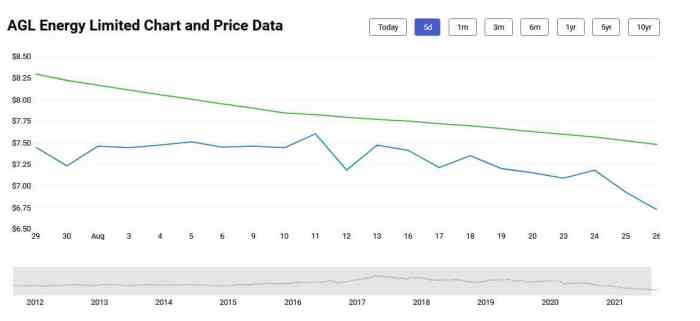

AGL has a rich history of share price performance that has been influenced by various milestones and events over time. Let's take a closer look at how AGL's share price has evolved.

Key Milestones and Events

- AGL's IPO in 2006 marked a significant starting point for its share price history, setting the initial valuation for investors.

- The global financial crisis in 2008 had a notable impact on AGL's share price, reflecting broader market trends and economic uncertainties.

- Strategic acquisitions and partnerships, such as the acquisition of a competitor or a major investment in renewable energy, often led to fluctuations in AGL's share price.

Patterns and Trends

- AGL's share price has shown resilience in the face of market volatility, demonstrating a stable performance over the long term.

- Seasonal factors, such as weather patterns affecting energy demand, can influence short-term fluctuations in AGL's share price.

- The transition towards renewable energy sources has become a key driver for AGL's share price, reflecting shifting investor preferences and regulatory changes.

Factors Influencing AGL Share Price

Investors tracking AGL's share price movements are often influenced by a variety of factors, both internal and external. Understanding these factors can provide valuable insights into the stock's performance and potential future trends.

External Factors Impacting AGL Share Price

External factors play a significant role in shaping AGL's share price trajectory. Market trends, industry news, economic conditions, and regulatory changes can all have a direct impact on how investors perceive the company's prospects and adjust their valuation accordingly.

- Market Trends: Fluctuations in the energy market, changes in demand for renewable energy sources, and global energy policies can all influence AGL's share price.

- Industry News: Developments within the energy sector, such as new technologies, competition, or regulatory shifts, can impact investor sentiment towards AGL.

- Economic Conditions: Macroeconomic factors like interest rates, inflation, and GDP growth can affect AGL's share price, especially in times of economic uncertainty.

- Regulatory Changes: Shifts in government policies related to energy production, emissions standards, or renewable energy incentives can directly impact AGL's operations and share price.

Internal Factors Affecting AGL Share Price

In addition to external influences, internal factors within AGL can also drive share price movements. Company earnings, management decisions, acquisitions, or strategic partnerships can all impact investor confidence and valuation of the stock.

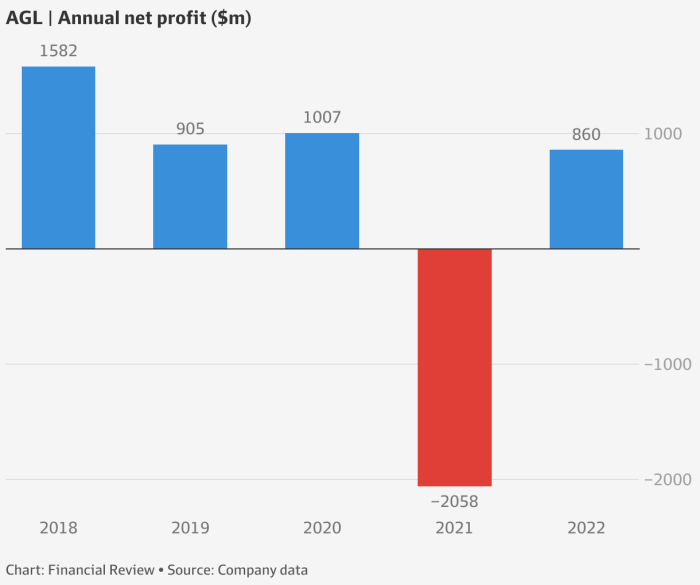

- Company Earnings: Quarterly financial reports, revenue growth, and profit margins can all influence how investors perceive AGL's financial health and future potential.

- Management Decisions: Leadership changes, strategic shifts, or operational decisions made by AGL's management team can impact investor sentiment and share price performance.

- Acquisitions: Mergers and acquisitions can signal growth opportunities or potential risks for AGL, leading to fluctuations in share price based on investor reactions.

- Strategic Partnerships: Collaborations with other companies or organizations can impact AGL's market positioning, product offerings, and growth prospects, influencing share price movements.

Comparing AGL Share Price Performance

Investors often compare AGL's share price performance with its competitors in the energy sector to gain insights into the company's financial health and market position. By analyzing how AGL's share price reacts to industry-specific events and broader market trends, investors can make more informed decisions regarding their investments.

Comparison with Competitors

- AGL's share price performance can be compared with competitors such as Origin Energy and EnergyAustralia to assess relative strength and weaknesses within the industry.

- Analyze key metrics like revenue growth, profitability, and market share to understand how AGL's share price stacks up against its peers.

Reaction to Industry Events and Market Trends

- Examine how AGL's share price reacts to events like changes in energy policy, fluctuations in commodity prices, or technological advancements in the sector.

- Compare AGL's share price movements with broader market trends to evaluate the company's performance in relation to the overall market conditions.

Unique Characteristics and Outliers

- Identify any unique characteristics or outliers in AGL's share price history compared to industry peers, such as sudden spikes or drops that are not in line with market expectations.

- Explore the reasons behind these outliers and assess their impact on AGL's overall performance and investor sentiment.

Investor Lessons from AGL Share Price History

Investors can glean valuable insights from studying AGL's share price history to inform their investment strategies. By analyzing the trends and patterns in AGL's historical share price performance, investors can make more informed decisions to optimize their portfolios.

Key Takeaways for Investors

- Long-Term Growth Potential: AGL's share price history may reveal the company's long-term growth potential. Investors can assess the trajectory of the stock over time to gauge its future performance and consider holding onto the stock for potential gains.

- Risk Management Strategies: Understanding how AGL's share price has responded to market fluctuations can help investors develop effective risk management strategies. By identifying historical trends, investors can better prepare for potential downturns and mitigate risks.

- Investment Timing: AGL's share price history can provide insights into optimal investment timing. By analyzing past price movements, investors can identify patterns that may indicate the best times to buy or sell AGL shares.

- Portfolio Diversification: Diversifying a portfolio is crucial for reducing risk. Studying AGL's share price history can help investors understand how the stock performs in relation to other assets, enabling them to diversify their investments effectively.

Ultimate Conclusion

In conclusion, the discussion on AGL Share Price History: What Investors Can Learn highlights important takeaways for investors, strategies derived from historical performance, and insights on risk management, investment timing, and portfolio diversification.

Key Questions Answered

What are some key milestones that influenced AGL's share price?

Some key milestones include major acquisitions, regulatory changes, and shifts in industry trends.

How did AGL's share price react to industry-specific events compared to broader market trends?

AGL's share price often reacted differently to industry-specific events than broader market trends due to its unique positioning and strategies.

What lessons can investors learn from studying AGL's share price history?

Investors can learn valuable insights on risk management, investment timing, and diversification strategies from AGL's share price history.