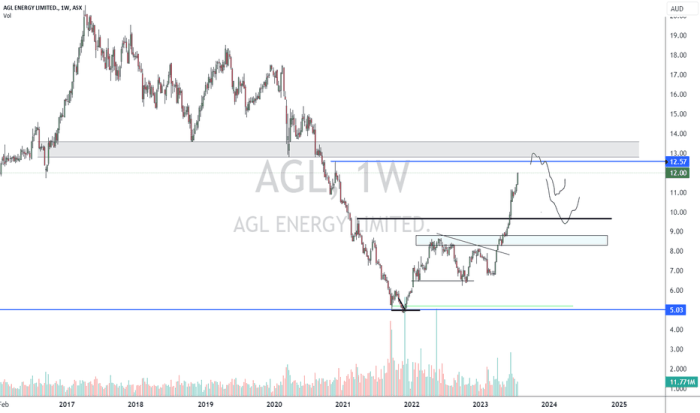

Exploring the dynamic forces behind the fluctuating AGL share price, this discussion delves into the diverse factors that influence its rise or fall. Get ready for a captivating journey through the financial landscape of AGL and uncover the secrets driving its market performance.

Factors Driving the AGL Share Price Up

In recent times, AGL has experienced a surge in its share price due to various positive factors. Let's delve into some of the key drivers behind this upward trend.

Positive Financial Performance Indicators

AGL has been able to showcase robust financial performance indicators, such as consistent revenue growth, improved profitability, and strong cash flow generation. This has instilled confidence in investors, leading to an increase in demand for AGL shares.

Major Partnerships and Acquisitions

AGL's strategic partnerships and acquisitions have also played a significant role in driving its share price up. For instance, collaborations with renewable energy companies or technology firms have not only expanded AGL's market reach but have also positioned the company as a key player in the evolving energy landscape.

These partnerships have been well-received by the market, resulting in a positive impact on AGL's share price.

Market Trends and Industry Developments

The ongoing shift towards renewable energy sources and the increasing focus on sustainability within the energy sector have favored AGL's position in the market. As a leading provider of renewable energy solutions, AGL has benefitted from these industry trends, attracting environmentally-conscious investors and driving up its share price.

Additionally, any positive regulatory changes or market developments that support AGL's business model have also contributed to the rise in its share price.

Factors Driving the AGL Share Price Down

Despite some positive factors impacting the AGL share price, there are several key factors that have contributed to its decline in recent times.

Impact of Negative News and Events

AGL has faced challenges due to negative news and events that have affected investor confidence and led to a decrease in share price. For example, recent reports of declining revenue or missed earnings targets can have a direct impact on the stock price.

Regulatory Changes and Challenges

Changes in regulations related to the energy sector can have a significant impact on AGL's operations and financial performance, thereby affecting its share price negatively. For instance, stricter environmental regulations or changes in government policies can create uncertainties for the company and its investors.

Internal Issues within AGL

Internal issues such as management changes, operational inefficiencies, or high levels of debt can also contribute to a decline in AGL's share price. Investors may react negatively to such internal challenges, leading to a decrease in the stock value.

Market Comparison

When comparing AGL's share price performance with its key competitors in the energy sector, it is important to consider how external factors have influenced these movements.

Competitive Landscape

AGL operates in a competitive market alongside companies like Origin Energy and EnergyAustralia. These competitors also experience share price fluctuations based on market conditions and industry trends.

Influence of Economic Conditions

- During times of economic uncertainty, all energy companies may see a decline in share prices as investors become more risk-averse.

- AGL's market positioning, such as its focus on renewable energy or cost-effective operations, can impact how it responds to economic conditions compared to competitors.

Global Events Impact

- Global events like geopolitical tensions or natural disasters can have a ripple effect on the energy sector, causing fluctuations in share prices for companies like AGL and its competitors.

- AGL's market positioning in terms of global reach and diversification can play a role in how it weathers global events compared to its competitors.

Future Outlook

The future outlook for AGL's share price is subject to various factors that could either drive it up or down. Analyst forecasts and expert opinions play a crucial role in predicting the potential direction of AGL's share price. Additionally, upcoming developments and strategies by AGL, as well as emerging trends in the energy sector, will heavily influence the future trajectory of AGL's share price.

Analyst Forecasts and Expert Opinions

Analysts predict a mixed outlook for AGL's share price, with some forecasting an increase due to the company's focus on renewable energy investments and potential cost-saving measures. On the other hand, some experts express concerns about regulatory challenges and market competition that could hinder AGL's share price growth.

Upcoming Developments and Strategies

AGL has announced plans to accelerate its transition to renewable energy sources and reduce its carbon footprint. This shift towards sustainable energy practices could attract environmentally conscious investors and positively impact AGL's share price. However, the success of these strategies will depend on the company's ability to effectively execute its plans amidst regulatory changes and market volatility.

Emerging Trends in the Energy Sector

The energy sector is experiencing a shift towards clean energy solutions and sustainability, driven by increasing global focus on climate change. As renewable energy sources become more affordable and accessible, companies like AGL that invest in green technologies may benefit from a positive market sentiment.

This trend could potentially boost AGL's share price in the future as investors prioritize environmentally responsible companies.

Conclusion

As we conclude our exploration of the factors impacting the AGL share price, we have gained valuable insights into the intricate web of influences shaping its trajectory. Whether it's soaring to new heights or facing challenges, AGL's share price is a reflection of a complex interplay of internal and external dynamics.

Commonly Asked Questions

What are some recent positive financial performance indicators of AGL?

Recent positive financial performance indicators of AGL include increased revenue, higher profit margins, and strong earnings growth.

Are there any major partnerships or acquisitions that have positively impacted AGL's share price?

Partnerships with key industry players and strategic acquisitions have contributed to boosting AGL's share price in recent times.

How do market trends or industry developments influence the rise in AGL's share price?

Market trends and industry developments such as renewable energy investments or regulatory changes can drive AGL's share price upwards.

What are some internal issues within AGL that may have led to a decrease in share price?

Internal issues like management changes, operational challenges, or financial setbacks can negatively impact AGL's share price.

How does AGL's market positioning affect its share price movement in relation to competitors?

AGL's market positioning relative to competitors plays a significant role in determining its share price movement, influencing investor perception and market demand.