Delving into What Is Revenue Based Financing? Complete Guide for Founders, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Revenue Based Financing is a financing model that has been gaining traction in the startup world, offering founders an alternative to traditional funding options. This guide aims to explore the intricacies of Revenue Based Financing and how it can benefit entrepreneurs looking to scale their businesses.

Introduction to Revenue Based Financing

Revenue Based Financing (RBF) is a type of funding that provides capital to businesses in exchange for a percentage of future revenue. Unlike traditional loans, RBF does not require fixed monthly payments but instead takes a percentage of the company's revenue until a predetermined amount is repaid.

How Revenue Based Financing Works

RBF investors provide capital to a business in exchange for a percentage of monthly revenue until a fixed multiple of the investment amount is reached. This means that in months where revenue is low, the payments are also lower, providing some flexibility to the business.

Once the agreed-upon amount is repaid, the obligation ends.

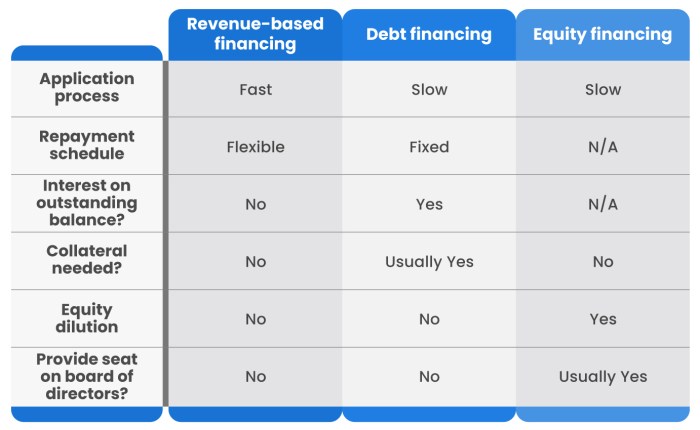

Comparing Revenue Based Financing with Traditional Financing

- RBF does not require fixed monthly payments, unlike traditional loans that have set repayment schedules.

- Traditional loans charge interest on the principal amount, while RBF investors take a percentage of revenue without accumulating interest.

- RBF is more flexible as payments are tied to revenue, making it potentially less burdensome during slow months compared to fixed loan payments.

- Traditional financing often requires collateral, while RBF is based on future revenue, making it accessible to companies with limited assets.

Benefits of Revenue Based Financing

Revenue Based Financing offers several key benefits for founders, especially for startups looking for alternative funding options. This financing model provides a unique way to access capital without giving up equity or taking on traditional debt.

Flexible Repayment Structure

One of the main advantages of Revenue Based Financing is the flexibility it offers in repayment. Unlike traditional loans with fixed monthly payments, RBF allows founders to repay based on a percentage of their monthly revenue. This means that during slower months, founders pay less, easing the financial burden on the business.

No Equity Dilution

Another significant benefit of Revenue Based Financing is that it does not require giving up equity in the company. This is particularly appealing for founders who want to maintain ownership and control of their business while still accessing the necessary capital to grow and scale.

Growth-Oriented Funding

Revenue Based Financing is ideal for startups that are focused on growth and scalability. By providing a source of capital tied directly to revenue, RBF can help founders invest in marketing, product development, hiring, and other growth initiatives without the pressure of fixed monthly repayments.

Quick Access to Capital

Compared to traditional funding options, Revenue Based Financing offers a faster and more streamlined approval process. This can be crucial for startups that need capital quickly to seize growth opportunities or address unexpected challenges.

Risk Sharing

With Revenue Based Financing, the risk is shared between the founder and the investor. If the business does not perform as expected, the investor bears some of the downside risk. This alignment of interests can lead to a more collaborative and supportive relationship between the founder and the investor.

Adaptability to Revenue Fluctuations

Since repayments are tied to revenue, Revenue Based Financing can adapt to fluctuations in the business's income. This can be especially beneficial for seasonal businesses or those with variable revenue streams, as the repayment amount adjusts accordingly.

Qualifications and Eligibility Criteria

When considering Revenue Based Financing as a funding option, founders should be aware of the typical qualifications and eligibility criteria required to secure this type of financing.

Typical Qualifications Required

- Stable and predictable revenue: Lenders typically look for businesses with a consistent revenue stream to ensure repayment.

- Minimum monthly revenue: There is usually a minimum revenue threshold that a business must meet to qualify for Revenue Based Financing.

- Positive growth trajectory: Lenders may prefer companies that show potential for growth and scalability.

- Clear financial statements: Founders may need to provide detailed financial statements to demonstrate the health of their business.

Eligibility Criteria

- Time in business: Some lenders may require a minimum number of months or years in operation to qualify for Revenue Based Financing.

- Legal entity: Businesses must be registered as a legal entity, such as an LLC or corporation, to be eligible.

- No outstanding liens or judgments: Lenders may conduct a background check to ensure there are no unresolved legal issues that could impact repayment.

Suitable Scenarios for Revenue Based Financing

Revenue Based Financing can be a suitable option for founders in various scenarios, including:

- Seasonal businesses: Companies that experience fluctuating revenue throughout the year may benefit from the flexibility of Revenue Based Financing.

- Startups with steady revenue: Early-stage startups with consistent revenue but limited assets may find Revenue Based Financing more accessible than traditional loans.

- Growth-oriented businesses: Companies looking to scale quickly and reinvest profits back into the business may prefer Revenue Based Financing due to its revenue-sharing model.

Repayment Structure

When it comes to Revenue Based Financing, the repayment structure is quite different compared to traditional loans. Instead of fixed monthly payments, repayments are based on a percentage of your monthly revenue.

Repayment Calculation

In Revenue Based Financing, repayments are calculated as a percentage of your monthly revenue. This percentage is agreed upon at the start of the financing arrangement and typically ranges from 2% to 8% of your monthly revenue. The repayment amount will fluctuate based on how well your business is performing each month.

If your revenue goes up, your repayment amount will increase, and vice versa.

Comparison of Repayment Models

- Fixed Percentage Model: In this model, a fixed percentage of your revenue is agreed upon at the beginning, and that percentage remains the same throughout the repayment period. This provides predictability for both the borrower and the lender.

- Sliding Scale Model: With this model, the percentage of revenue that needs to be repaid can vary based on your revenue levels. For example, if your revenue is below a certain threshold, the repayment percentage might be lower, but as your revenue increases, the percentage also increases.

This model allows for more flexibility based on your business's performance.

- Cap and Collar Model: This model sets a minimum and maximum limit for the repayment percentage. This provides a safety net for the borrower in case of fluctuations in revenue. If your revenue is below the minimum threshold, you pay the minimum percentage, and if it exceeds the maximum threshold, you pay the capped percentage.

Application Process

When applying for Revenue Based Financing, founders need to follow a structured process to increase their chances of approval. This process includes several steps and the submission of specific documentation.

Steps to Apply for Revenue Based Financing

- Research Lenders: Start by researching different lenders that offer Revenue Based Financing and compare their terms and requirements.

- Prepare Financial Documents: Gather financial statements, tax returns, and other relevant documents to demonstrate the revenue and financial health of your business.

- Submit Application: Fill out the application form provided by the lender, ensuring all information is accurate and up-to-date.

- Undergo Due Diligence: The lender will conduct due diligence on your business, reviewing your financials and assessing your revenue projections.

- Negotiate Terms: If approved, you may have the opportunity to negotiate the terms of the financing agreement before signing.

Common Documentation Required

- Financial Statements: Including profit and loss statements, balance sheets, and cash flow statements.

- Tax Returns: Personal and business tax returns for the past few years.

- Revenue Projections: Detailed revenue projections for the upcoming months/years to showcase the growth potential of your business.

- Legal Documents: Business registration documents, ownership information, and any existing loan agreements.

Ultimate Conclusion

In conclusion, What Is Revenue Based Financing? Complete Guide for Founders sheds light on a lesser-known yet powerful financing tool that can propel startups towards success. By understanding the nuances of Revenue Based Financing, founders can make informed decisions to fuel their growth and achieve their business goals.

General Inquiries

What are the typical qualifications required for Revenue Based Financing?

Qualifications usually include a minimum monthly revenue threshold, a certain time in business, and a healthy growth trajectory.

How are repayments calculated in Revenue Based Financing?

Repayments are typically a fixed percentage of monthly revenue until a predetermined total amount is repaid, usually with a cap on total repayment.

What are some common documentation required during the application process for Revenue Based Financing?

Common documents include financial statements, revenue reports, business plans, and sometimes personal guarantees from founders.