Embark on a journey through the world of Debt Financing as we delve into its advantages and disadvantages. This topic sheds light on the intricacies of borrowing money for business growth, offering a comprehensive look at the benefits and drawbacks that come with leveraging debt.

As we navigate through the various aspects of debt financing, we aim to provide a clear understanding of how this financial strategy can impact businesses in different ways.

Introduction to Debt Financing

Debt financing is a method of raising funds for a business by borrowing money from external sources. This type of financing involves taking on debt that must be repaid over a specific period, typically with interest.

Definition of Debt Financing

Debt financing refers to the practice of borrowing money to finance business activities, such as expanding operations, purchasing inventory, or investing in new equipment. This borrowed capital is obtained from lenders, such as banks, financial institutions, or private investors, who expect the principal amount to be repaid along with interest.

Borrowing Money for Business Operations

- Businesses often turn to debt financing when they need additional capital to grow or sustain operations. By taking on debt, companies can access funds quickly to cover expenses or invest in opportunities that can lead to increased revenue.

- Debt financing allows businesses to leverage their existing assets or future cash flows as collateral for loans, providing a way to secure funding without giving up ownership stakes.

- However, it's crucial for businesses to carefully manage their debt levels to avoid financial strain or defaulting on loan obligations.

Differences from Equity Financing

- Debt financing involves borrowing money that must be repaid with interest, while equity financing involves selling ownership stakes in the company in exchange for capital.

- With debt financing, businesses retain full ownership and control over their operations, but they are obligated to repay the borrowed funds according to the terms of the loan.

- In contrast, equity financing involves sharing ownership and potential profits with investors, but there is no requirement to repay the capital invested.

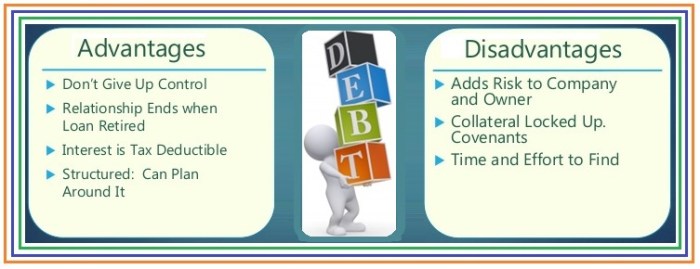

Advantages of Debt Financing

Debt financing can be a valuable tool for businesses looking to grow and expand their operations. By taking on debt, companies can benefit from several advantages that can help propel their business forward.

Quick Influx of Capital

One of the key advantages of debt financing is the ability to quickly access a significant amount of capital. Unlike other forms of financing that may require lengthy approval processes, debt financing can provide businesses with the funds they need in a relatively short amount of time.

This rapid influx of capital can be crucial for seizing new opportunities, investing in growth initiatives, or covering unexpected expenses.

Potential Tax Advantages

Another advantage of debt financing is the potential tax benefits it can offer to businesses. Interest payments on debt are typically tax-deductible, which can help lower the overall tax liability of a company. By leveraging debt to finance operations or expansions, businesses can optimize their tax strategy and potentially increase their after-tax profits.

Disadvantages of Debt Financing

Taking on debt for business purposes can have several drawbacks that need to be carefully considered before making a decision.

Risks Involved in Taking on Debt

- Increased financial risk: By borrowing money, a business exposes itself to the risk of not being able to meet its debt obligations in case of financial difficulties.

- Interest payments: Debt financing comes with interest payments, which can add up over time and increase the overall cost of borrowing.

- Limited flexibility: Debt agreements often come with strict terms and conditions that can limit a company's flexibility in managing its finances.

Impact on Financial Health

- High debt levels can lead to financial distress: If a company has too much debt, it may struggle to make payments, leading to financial distress and potential bankruptcy.

- Decreased creditworthiness: Excessive debt can lower a company's credit rating, making it harder to obtain financing in the future.

- Reduced profitability: The interest payments associated with debt can eat into a company's profits, reducing overall profitability.

Limitations on Future Growth

- Debt repayment obligations: The need to repay debt can restrict a company's ability to invest in growth opportunities, such as expanding operations or launching new products.

- Risk of overleveraging: Taking on too much debt can lead to overleveraging, where a company is unable to take on additional debt for future growth.

- Stifled innovation: High debt levels can limit a company's ability to innovate and stay competitive in the market.

Types of Debt Financing

Debt financing comes in various forms, each with its own unique characteristics and implications for businesses. Understanding the different types of debt financing is crucial for making informed financial decisions.

Loans

Loans are a common form of debt financing where a business borrows a specific amount of money from a financial institution or lender. The borrowed amount must be repaid with interest over a predetermined period.

Bonds

Bonds are another type of debt financing where a company issues bonds to investors who then lend money to the company. The company pays interest on the borrowed amount and repays the principal upon maturity of the bond.

Lines of Credit

Lines of credit are a flexible form of debt financing that allows businesses to borrow funds up to a predetermined credit limit. Interest is only charged on the amount borrowed, and businesses can repay and reborrow funds as needed.

Short-term vs. Long-term Debt Financing

When considering debt financing options, businesses must decide between short-term and long-term debt. Short-term debt financing typically has a maturity period of less than one year and is used to finance immediate needs like inventory or payroll. On the other hand, long-term debt financing has a maturity period exceeding one year and is used for larger investments like equipment purchases or expansion projects.

Choosing the Right Type of Debt Financing

It is crucial for businesses to choose the right type of debt financing based on their specific needs and financial goals. Factors to consider include the purpose of the funds, the ability to repay the debt, interest rates, and the impact on the company's overall financial health.

By selecting the appropriate type of debt financing, businesses can effectively manage their financial obligations and support their growth and development.

Factors to Consider When Opting for Debt Financing

When considering debt financing, there are several key factors that businesses need to take into account to make an informed decision. Factors such as interest rates, repayment terms, and creditworthiness play a crucial role in determining the feasibility and impact of debt financing on a company's financial health.

Interest Rates and Repayment Terms

Interest rates and repayment terms are essential factors to consider when opting for debt financing. High-interest rates can significantly increase the cost of borrowing, leading to higher repayment amounts. On the other hand, favorable repayment terms can provide flexibility and ease the financial burden on the company.

Therefore, businesses must carefully evaluate the interest rates offered by lenders and the repayment schedule to ensure it aligns with their financial capabilities.

Creditworthiness

A company's creditworthiness plays a vital role in determining its ability to secure favorable debt financing. Lenders assess a company's creditworthiness based on its financial history, credit score, and overall financial health. A strong credit profile can help a company secure better loan terms, lower interest rates, and higher borrowing limits.

On the contrary, a poor credit score can limit the company's access to debt financing and result in unfavorable loan terms. Therefore, it is crucial for businesses to maintain a healthy credit profile to enhance their chances of securing favorable debt financing options.

Last Point

In conclusion, the exploration of Debt Financing has unveiled a nuanced landscape of opportunities and challenges for businesses. Whether it's the allure of quick capital infusion or the looming risks of high debt levels, the decision to opt for debt financing requires careful consideration and strategic planning.

Question Bank

What are the main advantages of debt financing?

The main advantages include quick access to capital, potential tax benefits, and the ability to leverage debt for business growth.

What are the key risks associated with debt financing?

The risks involve financial strain from high debt levels, limitations on future growth, and potential default consequences.

How does creditworthiness impact debt financing decisions?

A company's creditworthiness influences its ability to secure favorable debt terms, affecting interest rates and repayment conditions.