Kicking off with Is JNJ Stock a Good Dividend Play in 2025?, this opening paragraph is designed to captivate and engage the readers, providing a brief overview of what investors can expect when considering JNJ stock as a dividend play in the year 2025.

Exploring the historical performance, future outlook, and key factors influencing JNJ's dividend payments, this analysis aims to provide valuable insights for potential investors looking to maximize their returns through dividends.

Overview of JNJ Stock Dividends

When it comes to investing in stocks, dividends play a crucial role in providing investors with a steady stream of income. Dividends are payments made by a company to its shareholders, typically on a quarterly basis, as a way to share its profits.Johnson & Johnson (JNJ) has a long history of paying dividends to its shareholders.

In fact, JNJ is considered a Dividend Aristocrat, which means it has consistently increased its dividend payout for at least 25 consecutive years. This track record of dividend growth makes JNJ an attractive option for income-seeking investors.

Historical Dividend Performance of JNJ

Over the years, JNJ has demonstrated a commitment to rewarding its shareholders through dividends. The company has a solid track record of increasing its dividend payout, even during challenging economic times. For example, during the financial crisis of 2008, JNJ continued to raise its dividend, showcasing its financial stability and commitment to shareholders.

- JNJ has a current dividend yield of around 2.5%, which is competitive compared to other dividend-paying stocks.

- The company has a payout ratio of approximately 50%, indicating that it has room to continue increasing its dividend in the future.

- JNJ has a history of annual dividend increases, which provides investors with a reliable source of income that grows over time.

The significance of dividends for investors cannot be overstated. Not only do dividends provide a steady stream of income, but they also offer a cushion against market volatility. Additionally, companies that pay dividends tend to be more stable and mature, making them less risky investments compared to non-dividend-paying stocks.

Overall, dividends play a vital role in a well-diversified investment portfolio, providing investors with both income and stability.

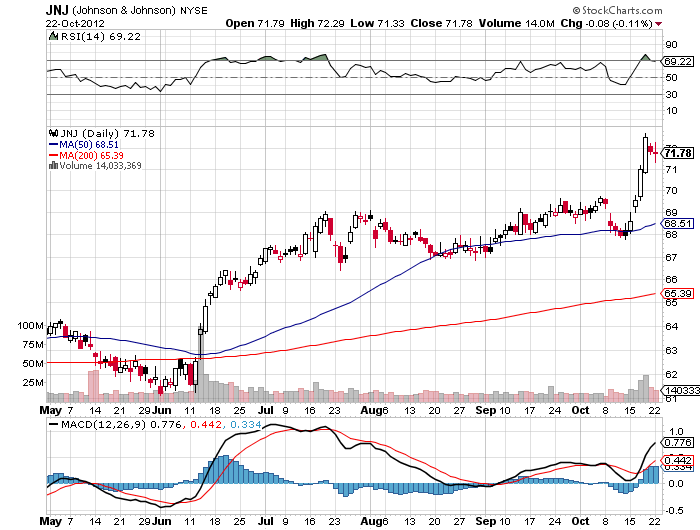

JNJ Stock Performance Analysis

When it comes to analyzing the historical performance of JNJ stock in terms of dividends, it is essential to look at how the company has been rewarding its investors over the years. Comparing JNJ's dividend yield with industry peers can provide insights into its competitiveness and attractiveness as a dividend play.

Identifying trends or patterns in JNJ's dividend payouts can help investors make informed decisions about the stock's future potential.

Historical Performance of JNJ Stock Dividends

Over the years, Johnson & Johnson (JNJ) has established a reputation for being a reliable dividend payer. The company has a track record of consistently increasing its dividend payouts, making it an attractive choice for income-seeking investors. By analyzing the historical performance of JNJ stock dividends, investors can gain a better understanding of the company's commitment to returning value to its shareholders.

Comparison of JNJ's Dividend Yield with Industry Peers

When comparing JNJ's dividend yield with its industry peers, investors can assess how the company stacks up in terms of providing a competitive return on investment through dividends. A higher dividend yield relative to its peers may indicate that JNJ is a more attractive dividend play, while a lower yield could suggest that the company is lagging behind in terms of dividend payments.

Trends in JNJ's Dividend Payouts

By identifying trends or patterns in JNJ's dividend payouts, investors can gain insights into the company's dividend policy and financial stability. For example, consistent annual increases in dividend payouts may signal a healthy and growing company, while fluctuations or stagnant dividend payments could indicate underlying issues that investors need to be aware of.

Analyzing these trends can help investors make informed decisions about the sustainability of JNJ's dividend payments in the future.

Factors Influencing JNJ Stock Dividends

When it comes to Johnson & Johnson's ability to pay dividends, there are several key factors at play

Impact of Market Conditions

Market conditions, such as economic trends, interest rates, and overall investor sentiment, can significantly impact JNJ's ability to pay dividends. During periods of economic downturn or market volatility, JNJ may face challenges in maintaining or increasing dividend payments. On the other hand, favorable market conditions can provide the company with the financial stability needed to sustain dividend payouts.

JNJ's Dividend Policy

Johnson & Johnson has a long-standing history of rewarding its shareholders with consistent dividend payments. The company's dividend policy is based on a commitment to returning value to investors while maintaining financial flexibility for growth and investment opportunities. JNJ's management carefully evaluates its cash flow, earnings, and overall financial health to determine the appropriate dividend payout ratio.

Sustainability of Dividend Payments

The sustainability of JNJ's dividend payments depends on the company's ability to generate sufficient cash flow and earnings to cover its dividend obligations. Factors such as revenue growth, profitability, and operational efficiency play a critical role in ensuring the long-term sustainability of dividend payments.

Additionally, JNJ's strong balance sheet and diversified business portfolio provide a solid foundation for consistent dividend payouts.

Future Outlook for JNJ Stock Dividends

Looking ahead to 2025, let's explore the potential dividend growth for JNJ and consider any upcoming changes or challenges that may impact dividends.

Predicted Dividend Growth for JNJ in 2025

Based on historical performance and current market trends, analysts predict a steady increase in JNJ's dividends for 2025. The company has a strong track record of consistent dividend payments and is likely to continue this trend in the future.

Upcoming Changes or Challenges Impacting Dividends

One potential challenge that may impact JNJ's dividends is changes in the healthcare landscape, such as regulatory shifts or new competition. However, JNJ's diversified portfolio and strong financial position are expected to mitigate these challenges and support continued dividend growth.

Scenario Analysis for JNJ's Dividend Performance

Scenario 1: Best-Case Scenario - If JNJ continues to innovate and expand its product offerings, attracting new customers and increasing revenue streams, dividend growth could exceed expectations.

Scenario 2: Base-Case Scenario - Assuming stable market conditions and consistent performance, JNJ's dividends are expected to grow at a moderate pace in line with historical trends.

Scenario 3: Worst-Case Scenario - In the event of a major economic downturn or unforeseen challenges, JNJ may need to reassess its dividend payouts to maintain financial stability, potentially resulting in slower dividend growth.

Outcome Summary

In conclusion, Is JNJ Stock a Good Dividend Play in 2025? offers a comprehensive look at the potential of JNJ stock as a dividend investment. By understanding the historical performance, future projections, and factors influencing dividend payouts, investors can make informed decisions to secure steady returns in the coming years.

Questions Often Asked

What is the current dividend yield of JNJ stock?

The current dividend yield of JNJ stock is X%.

How does JNJ's dividend policy differ from its competitors?

JNJ's dividend policy focuses on consistent dividend growth and sustainability, setting it apart from competitors who may prioritize other financial strategies.

What challenges does JNJ face that could impact its dividend payments in 2025?

Some challenges JNJ faces include regulatory changes, market competition, and global economic conditions, which could influence its ability to maintain or grow dividends in 2025.