As Ford Share Price vs Tesla: Who Leads the EV Market? takes center stage, this opening passage beckons readers with a captivating overview of the rivalry between two automotive giants, Ford and Tesla, in the rapidly evolving electric vehicle market.

By delving into their histories, current positions, strengths, and weaknesses, this discussion sets the stage for an insightful exploration of their financial performance and market dominance.

Ford vs. Tesla: Company Overview

Ford, one of the oldest automakers in the world, was founded by Henry Ford in 1903. Over the years, Ford has established itself as a household name in the automotive industry, producing a wide range of vehicles, including trucks, SUVs, and electric vehicles (EVs).

On the other hand, Tesla, founded by Elon Musk in 2003, has quickly risen to prominence as a leader in the EV market, known for its innovative technology and focus on sustainability.

Ford's Current Market Position

- Ford has a long history and brand recognition in the automotive industry.

- The company has a strong presence in the traditional gasoline-powered vehicle market.

- Ford has been making significant investments in EVs to compete in the growing electric vehicle market.

Tesla's Current Market Position

- Tesla is a pioneer in the EV market, known for its cutting-edge technology and high-performance electric vehicles.

- The company has a dedicated customer base and a strong brand image in the sustainable transportation sector.

- Tesla's market capitalization has surpassed that of traditional automakers, reflecting investor confidence in its future growth potential.

Ford's Key Strengths and Weaknesses in the EV Market

- Strengths:Ford's established brand and manufacturing capabilities give it a competitive edge in scaling up EV production. The company's experience in the automotive industry allows it to leverage existing infrastructure and supply chains.

- Weaknesses:Ford may face challenges in shifting its focus from traditional vehicles to EVs quickly. The company needs to invest more in research and development to match Tesla's technological advancements in the EV space.

Tesla's Key Strengths and Weaknesses in the EV Market

- Strengths:Tesla's innovative technology, such as its battery technology and autonomous driving features, sets it apart in the EV market. The company's focus on sustainability and brand loyalty gives it a competitive advantage.

- Weaknesses:Tesla's production capacity has been a challenge, leading to delays in vehicle deliveries. The company's high valuation and reliance on investor confidence pose risks in a volatile market.

Ford's EV Strategy

Ford has been making significant strides in the electric vehicle (EV) market with a focused strategy to compete with industry leader Tesla. Let's take a closer look at Ford's current lineup of electric vehicles, their investments in EV technology and infrastructure, as well as their partnerships and collaborations in the EV sector.

Ford's Current Lineup of Electric Vehicles

- Ford Mustang Mach-E: A fully electric SUV with impressive performance and range capabilities.

- Ford F-150 Lightning: An all-electric version of the popular Ford F-150 pickup truck, aimed at the commercial market.

- Ford E-Transit: An electric version of the iconic Ford Transit van, designed for the delivery and commercial fleet market.

Ford's Investment in EV Technology and Infrastructure

- Ford has committed to investing $22 billion in electrification through 2025, focusing on developing new electric vehicles and advanced battery technologies.

- The company is also expanding its charging infrastructure with the FordPass Charging Network, providing access to over 63,000 charging stations across North America.

Ford's Partnerships and Collaborations in the EV Sector

- Ford has partnered with Rivian, an electric vehicle startup, to develop an all-electric Lincoln SUV based on Rivian's platform.

- The company has also collaborated with Volkswagen to share EV technology and develop electric vehicles for the European market.

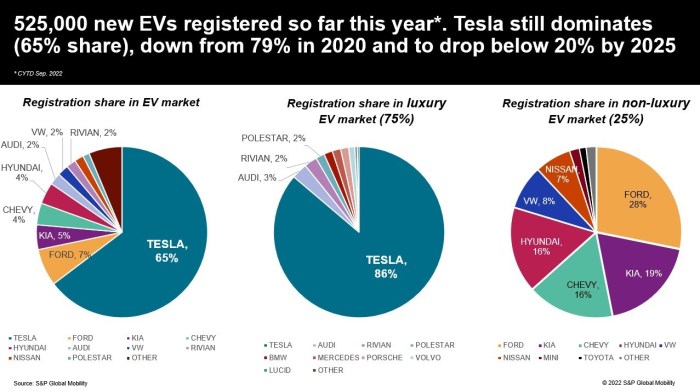

Tesla's Dominance in the EV Market

Tesla has established itself as a leader in the electric vehicle (EV) market with a range of popular models that have significantly impacted the industry. Their innovative approach to battery technology and autonomous driving has set them apart from competitors, while their global market presence and expansion strategies have solidified their position at the forefront of the EV revolution.

Popular EV Models and Market Impact

Tesla's Model S, Model 3, Model X, and Model Y have been well-received by consumers and critics alike, showcasing the company's commitment to high-performance electric vehicles. These models have not only driven Tesla's sales but have also influenced other automakers to invest more heavily in EV technology to keep up with the competition.

Innovation in Battery Technology and Autonomous Driving

Tesla's advancements in battery technology, specifically with their Gigafactories and development of high-capacity batteries, have allowed them to increase the range and efficiency of their vehicles. Additionally, their groundbreaking work in autonomous driving, with features like Autopilot and Full Self-Driving (FSD) capabilities, has pushed the boundaries of what is possible in the automotive industry.

Global Market Presence and Expansion Strategies

Tesla has expanded its presence globally, with manufacturing facilities in the United States, China, and soon in Germany. By establishing a strong foothold in key markets, Tesla has been able to reach a wider audience and increase their market share.

Their aggressive expansion strategies, including plans for additional Gigafactories and new vehicle models, demonstrate their commitment to growth and innovation in the EV market.

Ford Share Price vs. Tesla: Financial Performance

In the realm of electric vehicles, the financial performance of companies like Ford and Tesla plays a crucial role in determining their market position and investor confidence. Let's delve into a comparison of their stock performances and the factors influencing them.

Stock Performance Analysis

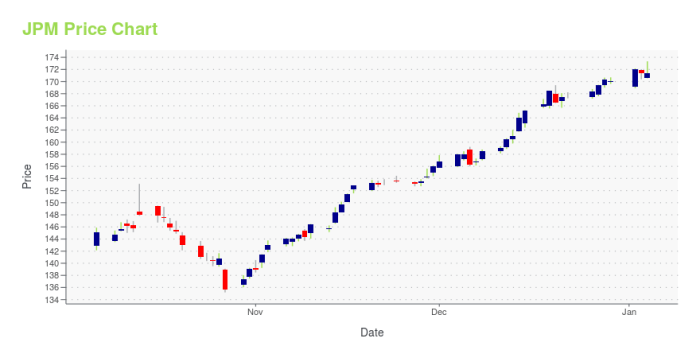

- Ford: Over the past year, Ford's stock price has shown steady growth, reflecting the company's strategic shift towards electric vehicles. Despite facing challenges in the traditional automotive market, Ford's foray into EVs has garnered investor interest and positively impacted its share price.

- Tesla: On the other hand, Tesla's stock price has been on a consistent upward trajectory, fueled by its dominant position in the EV market and innovative technological advancements. Tesla's brand value and market leadership have contributed significantly to its impressive stock performance.

Factors Influencing Stock Prices

- Market Trends: The overall shift towards sustainable energy and the increasing demand for electric vehicles have bolstered the stock prices of both Ford and Tesla. Companies aligning their strategies with these trends are likely to attract investor attention.

- News Impact: Positive announcements related to new EV models, partnerships, or technological breakthroughs can cause a surge in stock prices for both Ford and Tesla. Conversely, negative news regarding recalls, production delays, or regulatory issues may lead to a decline in share prices.

Last Recap

In conclusion, the comparison between Ford and Tesla in the EV market reveals a dynamic landscape where innovation, investment, and market strategies play crucial roles in determining leadership. With Ford's established legacy and Tesla's disruptive innovation, the competition for supremacy in the EV market is sure to continue driving excitement and advancements in the industry.

Common Queries

What factors contribute to Ford's current market position compared to Tesla in the EV sector?

Ford's strong brand recognition, extensive manufacturing capabilities, and strategic partnerships with other industry players contribute to its competitive position against Tesla.

How do Ford and Tesla differ in their approach to battery technology for electric vehicles?

Ford tends to focus on partnerships and collaborations for battery technology development, while Tesla has invested heavily in developing its in-house battery technology through companies like Maxwell Technologies and its Gigafactories.

What are the key challenges Ford faces in catching up to Tesla's dominance in the EV market?

Ford's historical reliance on internal combustion engine vehicles, slower pace of innovation compared to Tesla, and the need to build a robust charging infrastructure network pose significant challenges in competing with Tesla.