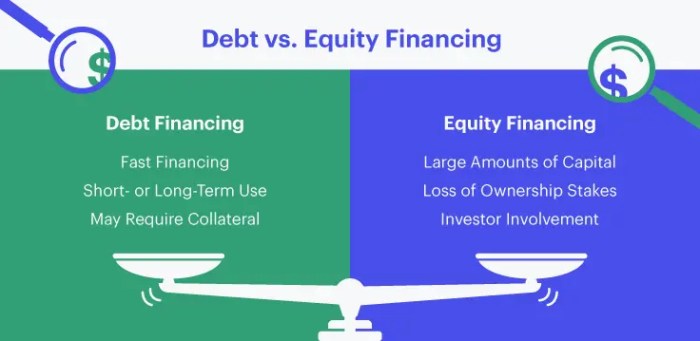

Exploring the disparities between Debt Financing and Equity Financing, this piece delves into the intricacies of financial decisions businesses face. By shedding light on these crucial disparities, readers are presented with a comprehensive understanding of the topic at hand.

Further details on the topic are elaborated in the subsequent paragraphs, providing a detailed analysis of the subject matter.

Introduction to Debt Financing and Equity Financing

Debt financing and equity financing are two common methods used by companies to raise capital for their operations and growth.

Debt financing involves borrowing money that must be repaid over time, typically with interest. On the other hand, equity financing involves selling a portion of ownership in the company in exchange for capital.

Debt Financing

Debt financing is often used by companies to fund specific projects, purchase assets, or cover operational expenses. It allows businesses to leverage borrowed funds to achieve their goals without diluting ownership.

- Example: A company takes out a bank loan to purchase new equipment for its manufacturing facility.

- Example: A startup secures a line of credit to cover operating costs until it becomes profitable.

Equity Financing

Equity financing is commonly used by startups and growing companies to raise capital without taking on additional debt. By selling shares of ownership, businesses can attract investors who share in the risks and rewards of the company's performance.

- Example: A tech startup offers equity to venture capitalists in exchange for funding to develop a new product.

- Example: A small business sells shares to angel investors to expand into new markets.

Pros and Cons of Debt Financing

Debt financing can be a valuable tool for businesses looking to raise capital, but it also comes with its own set of advantages and disadvantages.

Advantages of Using Debt Financing

- Lower Cost: Debt financing often comes with lower overall costs compared to equity financing, as interest payments are tax-deductible.

- Maintain Control: Taking on debt allows businesses to retain full ownership and control of the company, unlike equity financing which involves sharing ownership.

- Predictable Payments: With debt financing, businesses have a fixed repayment schedule, making it easier to budget and plan for future expenses.

- Build Credit: Making timely debt payments can help establish a positive credit history, making it easier to secure financing in the future.

Risks and Drawbacks of Debt Financing

- Interest Payments: The cost of servicing debt can add up over time, especially if interest rates rise or the business faces financial difficulties.

- Default Risk: Failing to make debt payments can lead to default, which can result in severe consequences such as bankruptcy or seizure of assets.

- Cash Flow Constraints: Debt repayment obligations can put a strain on cash flow, limiting the flexibility of the business to invest in growth opportunities.

- Lender Requirements: Lenders may impose restrictive covenants or other conditions that limit the business's operational or financial flexibility.

Cost Implications of Debt Financing vs. Equity Financing

| Factor | Debt Financing | Equity Financing |

|---|---|---|

| Cost | Lower overall cost due to tax-deductible interest payments | Higher cost as equity investors expect a return on their investment |

| Ownership | No dilution of ownership | Ownership is shared with investors |

| Risk | Default risk if payments are not made | No obligation to repay, but potential loss of control |

Pros and Cons of Equity Financing

Equity financing offers various benefits and drawbacks for businesses looking to raise capital. Let's delve into the advantages and challenges associated with equity financing.

Benefits of Equity Financing

- Access to Capital: Equity financing provides businesses with access to a significant amount of funds without incurring debt.

- Shared Risk: Investors who provide equity funding also share the risks and rewards of the business, aligning their interests with the success of the company.

- Expertise and Networks: Equity investors often bring valuable expertise, experience, and networks to the table, which can help businesses grow and succeed.

- No Repayment Obligations: Unlike debt financing, equity financing does not require regular repayments, easing the financial burden on the business.

Challenges of Equity Financing

- Dilution of Ownership: By issuing equity to investors, business owners dilute their ownership stake in the company, potentially losing control over key decisions.

- Profit Sharing: Equity investors are entitled to a share of the profits, which can impact the overall earnings available to the business owners.

- Lack of Flexibility: Investors may have their own agendas and expectations, limiting the flexibility of the business in terms of strategic decisions and operations.

- Valuation Challenges: Determining the value of the company and negotiating equity terms with investors can be complex and challenging.

Examples of Successful Businesses Utilizing Equity Financing

Several successful businesses have leveraged equity financing to fuel their growth and expansion. One notable example is Uber, which raised significant equity capital from investors to scale its ride-sharing platform globally. Another example is Airbnb, which utilized equity financing to develop its online marketplace for lodging and experiences.

Key Differences in Risk and Control

When considering debt financing versus equity financing, one crucial aspect to analyze is the impact on risk and control within a business. Debt financing and equity financing have distinct implications for the risk profile and control and ownership structure of a company.

Impact of Debt Financing on Risk

Debt financing involves borrowing funds that need to be repaid with interest. This introduces a fixed obligation to meet debt payments, irrespective of the company's profitability. The use of debt increases financial risk as failure to meet repayment obligations can lead to bankruptcy or insolvency.

However, debt financing does not dilute ownership or control of the business.

- Increases financial risk due to fixed repayment obligations

- Defaulting on debt can lead to bankruptcy

- Does not dilute ownership or control

Influence of Equity Financing on Control and Ownership

Equity financing involves selling a portion of ownership in the business in exchange for capital. This dilutes ownership but does not create a fixed obligation for repayment. Equity investors become shareholders with voting rights, impacting the control and decision-making processes of the company.

- Dilutes ownership as investors become shareholders

- Does not create fixed repayment obligations

- Equity investors have voting rights affecting control

Long-Term Implications of Risk and Control

The choice between debt and equity financing can have lasting effects on the risk exposure and control dynamics of a business. While debt financing carries higher financial risk, it allows the retention of ownership and control. On the other hand, equity financing reduces financial risk but involves sharing ownership and decision-making authority with investors.

- Debt financing retains ownership and control but increases financial risk

- Equity financing reduces financial risk but involves sharing ownership and control

- Long-term implications impact company's growth and strategic decisions

Impact on Financial Statements

Debt financing and equity financing have distinct impacts on a company's financial statements, influencing how the business appears in terms of its financial health, leverage, and ownership structure.

Debt Financing on Balance Sheet

Debt financing involves borrowing funds that must be repaid over time, typically with interest. When a company takes on debt, it appears as a liability on the balance sheet. This increases the company's total liabilities and total assets, reflecting the borrowed capital that needs to be repaid in the future.

Effects of Equity Financing

Equity financing, on the other hand, involves selling shares of ownership in the company to investors in exchange for capital. This does not create a liability on the balance sheet like debt does. Instead, equity financing increases the company's equity or net worth, providing a boost to the business's financial standing without incurring debt obligations.

Impact on Financial Ratios

Both debt and equity financing impact key financial ratios, such as the debt-to-equity ratio. The debt-to-equity ratio measures the proportion of debt to equity in a company's capital structure.

Debt-to-Equity Ratio = Total Debt / Total Equity

Debt financing, with its increase in liabilities, raises the debt-to-equity ratio, signaling higher financial leverage and potential risk. On the other hand, equity financing reduces the ratio by boosting equity without affecting debt, indicating a lower level of financial risk and reliance on borrowed funds.

Final Summary

In conclusion, the comparison between Debt Financing and Equity Financing underscores the importance of strategic financial planning for businesses. By weighing the pros and cons of each approach, companies can make informed decisions that align with their long-term goals.

FAQ Compilation

What are the main advantages of Debt Financing over Equity Financing?

Debt financing allows businesses to retain control and ownership, unlike equity financing where ownership is diluted among shareholders.

How does Debt Financing impact a company's financial statements?

Debt financing is reflected as a liability on the balance sheet, leading to an increase in interest expenses which can impact profitability.

Can a business use both Debt and Equity Financing simultaneously?

Yes, a company can combine debt and equity financing to leverage the benefits of both types of funding sources.