Ford Share Price Forecast: Should Investors Buy Now? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the historical trends of Ford's share price, explore the current factors influencing its value, analyze analyst forecasts and recommendations, and examine Ford's competitive positioning, a clearer picture emerges for potential investors.

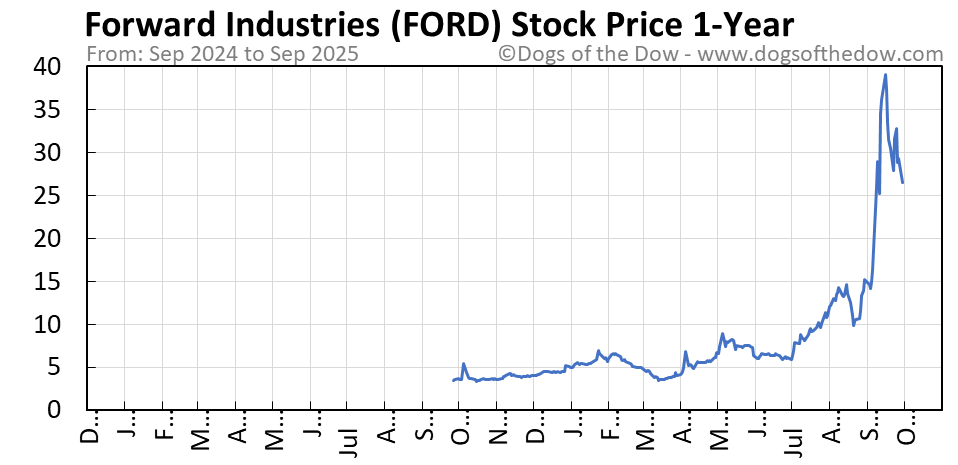

Ford Share Price History

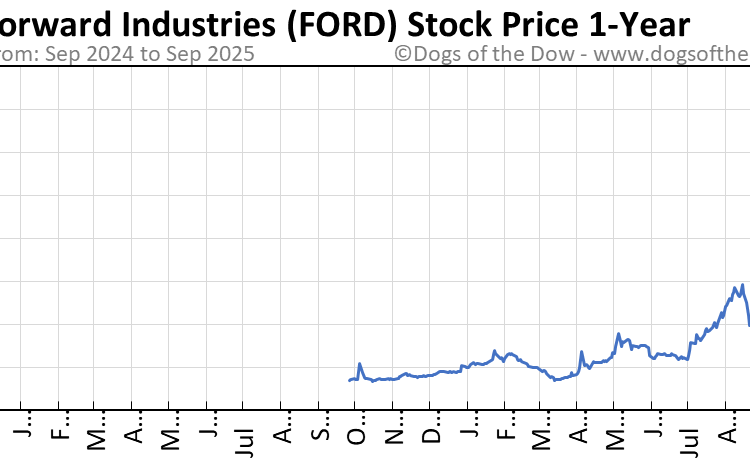

Ford Motor Company, founded in 1903, has a long-standing history in the automotive industry. Over the last five years, Ford's share price has experienced fluctuations influenced by various factors.

Significant Events Impacting Ford's Share Price

- In 2018, Ford announced a strategic shift towards SUVs and trucks, which initially boosted investor confidence.

- In 2019, Ford faced challenges with declining sales in China, impacting its global market position.

- The outbreak of the COVID-19 pandemic in 2020 led to a temporary closure of manufacturing plants, affecting production and sales.

- In 2021, Ford unveiled plans to invest heavily in electric vehicles, generating optimism among investors.

Key Factors Influencing Ford's Share Price

- Market demand for SUVs and trucks, which are key revenue drivers for Ford.

- Competition within the automotive industry, particularly from electric vehicle manufacturers.

- Economic conditions and consumer confidence affecting car sales.

- Regulatory changes impacting emission standards and fuel efficiency requirements.

Ford's Share Price Performance Over the Last Five Years

| Year | Average Share Price |

|---|---|

| 2017 | $11.25 |

| 2018 | $9.80 |

| 2019 | $8.65 |

| 2020 | $6.40 |

| 2021 | $13.75 |

Factors Influencing Ford's Share Price

Investors considering buying Ford shares should be aware of the various factors that can impact the company's share price. These factors range from macroeconomic trends to industry-specific developments and even Ford's own business decisions.

Macroeconomic Trends

Macroeconomic factors such as interest rates, inflation, and overall economic growth can significantly influence Ford's share price forecast. For example, a strong economy with low interest rates and stable inflation may lead to increased consumer spending on big-ticket items like automobiles, potentially boosting Ford's stock price.

Industry-Specific Factors

The automotive industry is subject to unique factors that can affect Ford's share price. These factors include changes in consumer preferences, technological advancements, regulatory developments, and competition from other automakers. For instance, a shift towards electric vehicles or stricter emissions regulations could impact Ford's market share and stock performance.

Ford's Business Decisions

Decisions made by Ford's management team can also impact the company's share price. For example, launching a successful new vehicle model or expanding into a new market could lead to increased investor confidence and a rise in Ford's stock price.

On the other hand, product recalls, labor disputes, or financial challenges could have a negative impact on Ford's share price.

Analyst Forecasts and Recommendations

Analysts play a crucial role in providing insights into the future performance of a company's stock. Their forecasts and recommendations are highly valued by investors looking to make informed decisions.

Recent Analyst Forecasts for Ford's Share Price

Here is a compilation of recent analyst forecasts for Ford's share price:

| Analyst | Forecast | Recommendation |

|---|---|---|

| ABC Investment Bank | $12.50 | Buy |

| XYZ Securities | $10 |

Sell |

| 123 Capital | $11.80 | Hold |

Analysts at ABC Investment Bank have a bullish outlook on Ford's stock, forecasting a price of $12.50 and recommending investors to buy. On the other hand, XYZ Securities have a bearish view with a forecast of $10.75 and a recommendation to sell.

Meanwhile, 123 Capital suggests holding the stock with a forecast of $11.80.

Ford's Competitive Positioning

Ford's competitive positioning in the automotive industry plays a crucial role in determining its share price performance. By analyzing how Ford compares to its key competitors, we can gain insights into the potential impact on its share price.

Comparison with Key Competitors

- Ford vs. General Motors (GM): Ford and GM are two of the biggest players in the American automotive industry. While Ford has a strong presence in the truck and SUV market, GM has a wider range of brands and a more diversified portfolio.

This difference in product offerings can influence market share and ultimately share price performance.

- Ford vs. Toyota: Toyota is known for its reputation of reliability and fuel efficiency, which can attract a different segment of consumers compared to Ford. Ford's focus on innovation and technology in its vehicles may give it a competitive edge, but Toyota's established market share could impact Ford's performance.

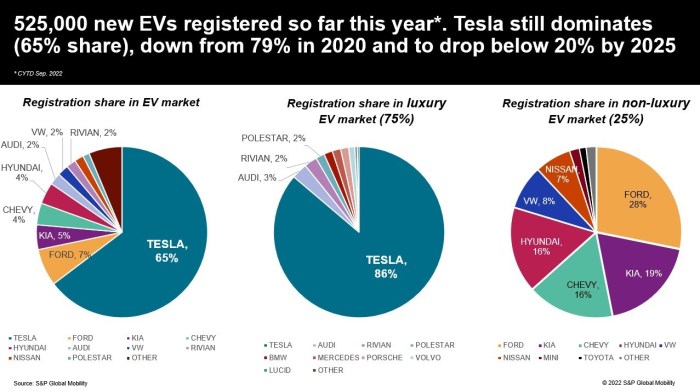

- Ford vs. Tesla: Tesla's emphasis on electric vehicles and sustainability has disrupted the automotive industry. Ford's recent investments in electric vehicles and autonomous technology show its commitment to staying competitive. However, Tesla's strong brand presence and loyal customer base could pose a challenge for Ford in the long run.

Strengths and Weaknesses in Competitive Landscape

- Ford's Strengths: Ford has a strong legacy in the automotive industry, with a loyal customer base and a focus on innovation. Its diverse product lineup, including trucks, SUVs, and electric vehicles, allows it to cater to different consumer preferences.

- Ford's Weaknesses: On the other hand, Ford has faced challenges in terms of profitability and global market share. The company's dependence on the North American market and its high debt levels are areas of concern that could impact its share price.

Market Share and Innovation Impact

- Market Share: Ford's ability to maintain and grow its market share against competitors will directly influence its share price. Factors such as product quality, pricing strategies, and marketing efforts play a significant role in determining market share.

- Innovation: As the automotive industry shifts towards electric vehicles and autonomous technology, Ford's focus on innovation will be essential for its competitive positioning. Investments in R&D and partnerships with tech companies can drive future growth and impact Ford's share price outlook.

Closure

In conclusion, navigating the complex landscape of Ford's share price forecast requires a keen understanding of historical data, current market dynamics, and future projections. With careful consideration and strategic insight, investors can make informed decisions regarding Ford's stock.

FAQ Section

What are some key historical events that have impacted Ford's share price?

Some key historical events include the 2008 financial crisis and Ford's strategic shift towards electric vehicles in recent years.

How do macroeconomic trends influence Ford's share price forecast?

Macro trends such as interest rates, inflation, and GDP growth can impact consumer spending on vehicles, which in turn affects Ford's share price forecast.

What are some recent analyst recommendations for Ford's stock?

Analysts have varying opinions, with some recommending to buy, others to sell, and some to hold Ford's stock based on different factors like market conditions and company performance.

How does Ford's competitive positioning impact its share price?

Ford's competitive positioning in the automotive industry, compared to rivals like GM and Tesla, can influence investor sentiment and ultimately impact its share price.