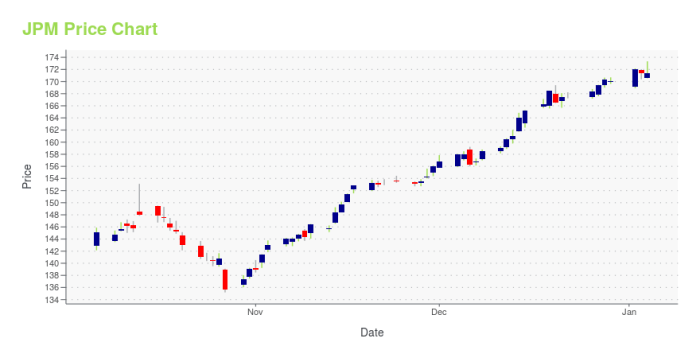

Exploring the potential of JPM Stock as the top bank stock to invest in 2025 sets the stage for a compelling journey into the world of finance. With a focus on key factors and expert insights, this discussion promises to uncover valuable perspectives for investors.

Delving deeper into the realm of bank stocks and financial markets, this article aims to shed light on the considerations surrounding JPM Stock in the upcoming year.

Factors influencing the performance of bank stocks

The performance of bank stocks can be influenced by various factors, including economic indicators, regulatory changes, and key financial metrics that investors consider when evaluating their investment options.

Economic Indicators Impact on Bank Stock Prices

Economic indicators such as interest rates and inflation can have a significant impact on bank stock prices. When interest rates are low, banks may experience lower margins on their lending activities, affecting their profitability and stock prices. On the other hand, rising interest rates can lead to higher profits for banks, driving their stock prices up.

Similarly, inflation can erode the value of money, affecting consumer spending and borrowing behavior, which in turn can impact bank revenues and stock performance.

Regulatory Changes in the Banking Industry

Regulatory changes can also play a crucial role in influencing the performance of bank stocks. Stricter regulations imposed by government agencies can increase compliance costs for banks, affecting their bottom line and stock prices. On the other hand, regulatory reforms aimed at improving transparency and stability in the banking sector can boost investor confidence and drive up stock prices.

Key Financial Metrics for Evaluating Bank Stocks

Investors often consider key financial metrics when evaluating bank stocks. These metrics include factors such as return on equity (ROE), net interest margin (NIM), price-to-earnings (P/E) ratio, and loan-to-deposit ratio. ROE reflects a bank's profitability, NIM indicates its earning potential from interest-bearing assets, P/E ratio compares the stock price to its earnings, and the loan-to-deposit ratio shows the bank's ability to generate income from its loan portfolio relative to its deposits.

These metrics help investors assess the financial health and performance potential of a bank stock.

JPMorgan Chase & Co. overview

JPMorgan Chase & Co. is a multinational investment bank and financial services company headquartered in New York City. It is one of the largest banks in the United States and a leading player in the global financial industry.JPMorgan Chase & Co.

was formed in 2000 through the merger of Chase Manhattan Corporation and J.P. Morgan & Co. The company has a rich history dating back to the 19th century when the original J.P. Morgan & Co. was founded by J.P.

Morgan, a prominent financier and banker.

Significance of JPMorgan Chase & Co.

JPMorgan Chase & Co. holds a significant position in the banking sector due to its size, influence, and diversified business operations. The company's strong presence in both investment banking and commercial banking makes it a key player in the global financial markets.

- JPMorgan Chase & Co. is one of the largest investment banks in the world, providing a wide range of financial services to corporations, governments, and institutional clients.

- The company also has a strong presence in retail banking, serving millions of customers through its network of branches and digital banking platforms.

- JPMorgan Chase & Co. operates in various business segments, including asset management, commercial banking, consumer banking, and investment banking.

Comparison of JPMorgan Chase & Co. with other bank stocks

When comparing JPMorgan Chase & Co. with other bank stocks, it's essential to look at their financial performance, market positioning, strengths, and weaknesses.

Financial Performance Analysis

- JPMorgan Chase & Co. has consistently reported strong financial results, with stable revenue growth and profitability.

- Compared to its competitors, JPMorgan Chase & Co. may show higher returns on assets and equity, indicating efficient management of assets and shareholder value.

- However, factors like interest rate fluctuations and economic conditions can impact the financial performance of all bank stocks.

Market Positioning Evaluation

- JPMorgan Chase & Co. is one of the largest banks globally, with a significant market share in various financial services.

- Compared to its competitors, JPMorgan Chase & Co. may have a more diversified business model, offering a range of services from retail banking to investment banking.

- The bank's global presence and brand reputation contribute to its strong market positioning in the financial industry.

Strengths and Weaknesses Assessment

- JPMorgan Chase & Co. benefits from a robust risk management framework, which helps in navigating challenging market conditions.

- On the other hand, the bank may face challenges related to regulatory compliance and potential legal risks, which could impact its overall performance.

- Compared to other bank stocks, JPMorgan Chase & Co. may have a competitive edge in certain areas while needing improvement in others.

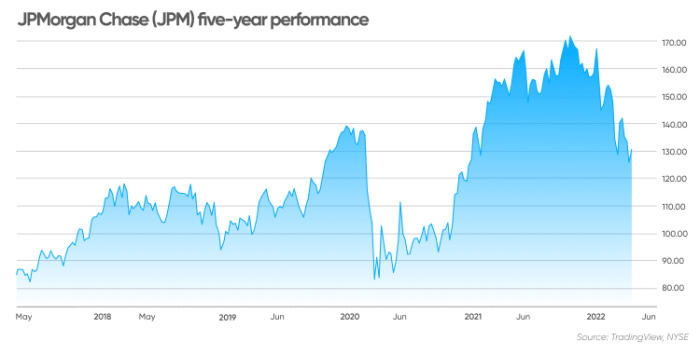

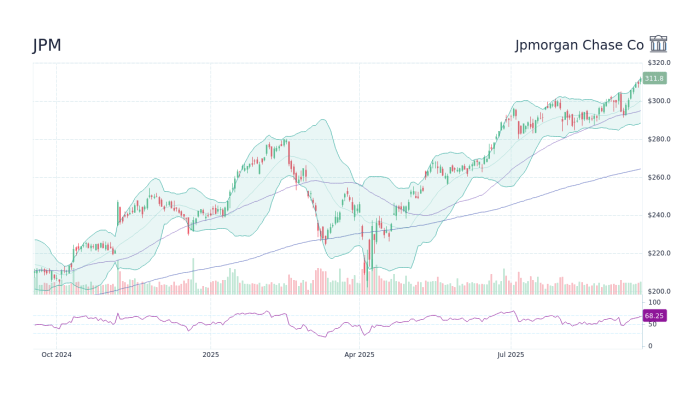

Predictions and forecasts for JPMorgan Chase & Co. in 2025

In 2025, experts predict a positive outlook for JPMorgan Chase & Co. as the bank continues to solidify its position in the financial industry. With a strong foundation and a track record of success, JPMorgan Chase & Co. is expected to thrive in the coming years.

Potential Growth Opportunities

- JPMorgan Chase & Co. may see growth opportunities in expanding its digital banking services to reach a wider customer base.

- The bank could capitalize on emerging markets and invest in innovative technologies to enhance its competitive edge.

- Strategic acquisitions or partnerships may further strengthen JPMorgan Chase & Co.'s market presence and offerings.

Challenges to Consider

- Increased regulatory scrutiny could pose challenges for JPMorgan Chase & Co. in terms of compliance and risk management.

- Market volatility and economic uncertainties may impact the bank's performance and profitability.

- Rising competition from fintech companies could require JPMorgan Chase & Co. to adapt and innovate to stay ahead.

Impact of Global Economic Trends

- Global economic trends, such as interest rate changes and geopolitical events, could influence JPMorgan Chase & Co.'s investment decisions and revenue streams.

- Market shifts and trade policies may affect the bank's international operations and revenue growth.

- Changing consumer behaviors and preferences in different regions could shape JPMorgan Chase & Co.'s product development and marketing strategies.

Conclusive Thoughts

As we wrap up our exploration of JPM Stock's potential in 2025, it becomes evident that the landscape of bank stocks offers a plethora of opportunities and risks. With a nuanced understanding of market dynamics and forecasts, investors can navigate the complexities of the financial sector with confidence.

Frequently Asked Questions

Is JPM Stock a safe investment option for 2025?

JPM Stock's stability and growth potential make it a favorable choice for investors looking for long-term returns in 2025. However, like any investment, thorough research is essential to make informed decisions.

What sets JPM Stock apart from other bank stocks?

JPM Stock's strong financial performance, diversified business segments, and market positioning distinguish it from its competitors, making it an attractive investment option for 2025.

How do global economic trends impact JPM Stock's performance?

Global economic trends, such as interest rates and inflation, can significantly influence JPM Stock's performance in 2025. It is crucial for investors to monitor these factors for informed decision-making.