Kicking off with JNJ Stock Price Today: Real-Time Market Analysis, this opening paragraph is designed to captivate and engage the readers, providing a comprehensive look at the current market situation of Johnson & Johnson. From its historical background to the recent stock price trends, this analysis delves into the key factors influencing JNJ's performance in the healthcare sector.

JNJ Stock Overview

Johnson & Johnson (JNJ) is a multinational corporation that was founded in 1886, specializing in pharmaceuticals, medical devices, and consumer health products. Over the years, JNJ has established itself as a leader in the healthcare industry, known for its innovative products and commitment to quality.The current market capitalization of JNJ is approximately $450 billion, making it one of the largest healthcare companies in the world.

This reflects the confidence investors have in the company's long-term growth potential and stability.

Comparative Stock Performance

When comparing JNJ's stock performance to its competitors in the healthcare sector, such as Pfizer, Merck, and Abbott Laboratories, JNJ has shown consistent growth and resilience. Despite facing challenges in the industry, JNJ has managed to maintain a strong position in the market, thanks to its diverse portfolio of products and strategic investments in research and development.

- JNJ's stock price has outperformed many of its competitors over the years, showing steady growth and stability.

- Investors often view JNJ as a safe investment option due to its solid financial performance and track record of delivering value to shareholders.

- While competition in the healthcare sector remains fierce, JNJ continues to innovate and expand its product offerings to stay ahead of the curve.

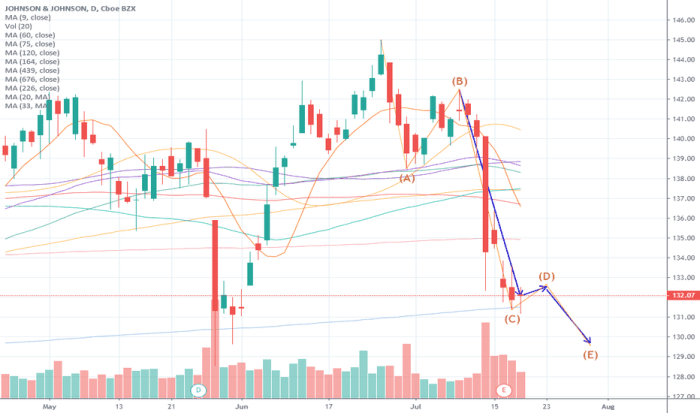

Real-Time Stock Price Analysis

Real-time stock prices in the financial markets are determined by the continuous buying and selling of shares by investors. These prices are updated constantly throughout the trading day based on supply and demand dynamics, market sentiment, company performance, economic indicators, and other factors.

Factors Influencing JNJ's Stock Price Fluctuations

- Company Earnings: Johnson & Johnson's quarterly earnings reports can significantly impact its stock price. Positive earnings growth often leads to an increase in stock value.

- Market Trends: Overall market trends and movements can influence JNJ's stock price. If the market is bullish, JNJ's stock price may rise as well.

- Regulatory News: Any regulatory news related to Johnson & Johnson's products, such as FDA approvals or recalls, can cause fluctuations in the stock price.

- Competition: Actions taken by competitors in the healthcare industry can affect JNJ's stock price. Increased competition or new product launches can impact investor sentiment.

Recent News Impacting JNJ's Stock Price Today

- Johnson & Johnson announced a new acquisition that is expected to diversify its product portfolio and potentially drive future growth.

- An analyst upgrade of JNJ stock based on strong sales projections for an upcoming product launch has positively influenced investor sentiment.

- Reports of a lawsuit against Johnson & Johnson alleging product liability issues have created uncertainty in the market, leading to a slight dip in the stock price.

Market Trends and Performance

The recent trends in JNJ's stock price movements have shown a steady increase over the past few months, reflecting positive investor sentiment towards the company. Despite some fluctuations, the overall trajectory has been upwards, indicating a strong performance in the market.

Comparison to Historical Performance

When comparing JNJ's current stock price to its historical performance, we can see that the stock has shown resilience and consistency over the years. The company has a track record of delivering value to its shareholders, which has helped maintain a stable stock price even during challenging market conditions.

Analyst Recommendations and Forecasts

Analysts have generally been bullish on JNJ's stock, with many recommending it as a buy or hold. Forecasts suggest that the stock has the potential for further growth in the future, driven by its strong product pipeline and solid financial performance.

It is important to consider these recommendations along with your own research before making investment decisions.

Investor Sentiment and Impact

Investor sentiment plays a crucial role in determining the stock price of companies like JNJ. It refers to how investors feel about a particular stock, which can influence their buying and selling decisions.

Sentiment Towards JNJ Stock Today

- Today, investor sentiment towards JNJ stock seems positive, as the company recently reported strong earnings and positive growth prospects.

- Many investors are optimistic about JNJ's future performance, leading to an increase in demand for the stock.

- Analyst recommendations and market buzz also contribute to the overall positive sentiment surrounding JNJ stock today.

Impact of Investor Sentiment on Stock Prices

- Positive investor sentiment usually drives up stock prices, as more investors are willing to buy the stock, increasing demand and pushing prices higher.

- Conversely, negative sentiment can lead to a decrease in stock prices, as investors may sell off their shares, causing a decline in demand and a drop in prices.

- Overall, investor sentiment can create volatility in stock prices and influence short-term fluctuations in the market.

External Factors Affecting JNJ's Stock Price

- Economic indicators such as GDP growth, inflation rates, and interest rates can impact JNJ's stock price by influencing consumer spending, healthcare demand, and overall market conditions.

- Global events like trade tensions, geopolitical instability, and health crises can also affect JNJ's stock price by introducing uncertainty and changing market dynamics.

- Investors closely monitor these external factors to gauge their potential impact on JNJ's performance and adjust their investment decisions accordingly.

Concluding Remarks

In conclusion, JNJ Stock Price Today: Real-Time Market Analysis sheds light on the dynamic nature of stock prices and market trends, offering valuable insights for investors and enthusiasts alike. Whether exploring JNJ's stock performance or understanding investor sentiment, this analysis serves as a reliable resource for staying informed in the ever-changing financial landscape.

FAQ Summary

What is Johnson & Johnson's historical background?

Johnson & Johnson, founded in 1886, has a rich history in the healthcare industry, known for its diverse range of products and commitment to innovation.

How are real-time stock prices determined?

Real-time stock prices are determined by the continuous matching of buy and sell orders on stock exchanges, reflecting the current market demand and supply for a particular stock.

What factors influence JNJ's stock price fluctuations?

JNJ's stock price fluctuations can be influenced by various factors, including company earnings reports, industry trends, economic conditions, and regulatory changes.

Are there any recent news or events impacting JNJ's stock price today?

Recent news or events, such as FDA approvals for new products, legal disputes, or changes in healthcare policies, can impact JNJ's stock price in real-time.