Exploring the trajectory of the AGL share price in the long term, this discussion delves into the various factors influencing its movement, historical performance, future growth prospects, as well as the risks and challenges it faces. With a comprehensive analysis, readers can gain valuable insights into where the AGL share price may be headed.

Factors Influencing AGL Share Price

When it comes to the AGL share price, there are several key factors that can influence its movement in the market. These factors include economic indicators, market trends, and company performance.

Economic Indicators

Economic indicators play a crucial role in determining the direction of stock prices, including those of AGL. Factors such as interest rates, inflation rates, GDP growth, and employment numbers can all impact investor sentiment and ultimately affect the share price.

For example, if the economy is experiencing high inflation, investors may be more hesitant to invest in stocks like AGL, leading to a decrease in share price.

Market Trends

Market trends also have a significant impact on the share price of AGL. For instance, if there is a general uptrend in the stock market, AGL's share price is likely to be positively affected as well. Conversely, during a market downturn, AGL's share price may experience a decline due to overall market sentiment.

It is essential for investors to closely monitor market trends to anticipate potential movements in the share price of AGL.

Company Performance

The performance of AGL as a company is another critical factor that influences its share price. Factors such as revenue growth, profitability, market share, and strategic decisions made by the company's management can all impact investor confidence in AGL's stock.

Strong performance indicators can attract more investors, leading to an increase in share price, while poor performance may result in a decrease in share price as investors lose confidence in the company's ability to generate returns.

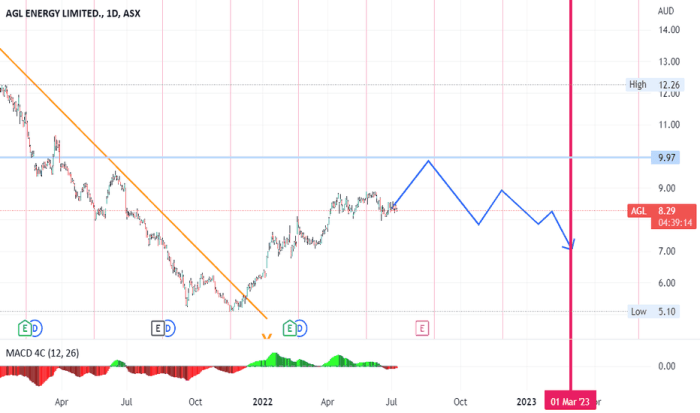

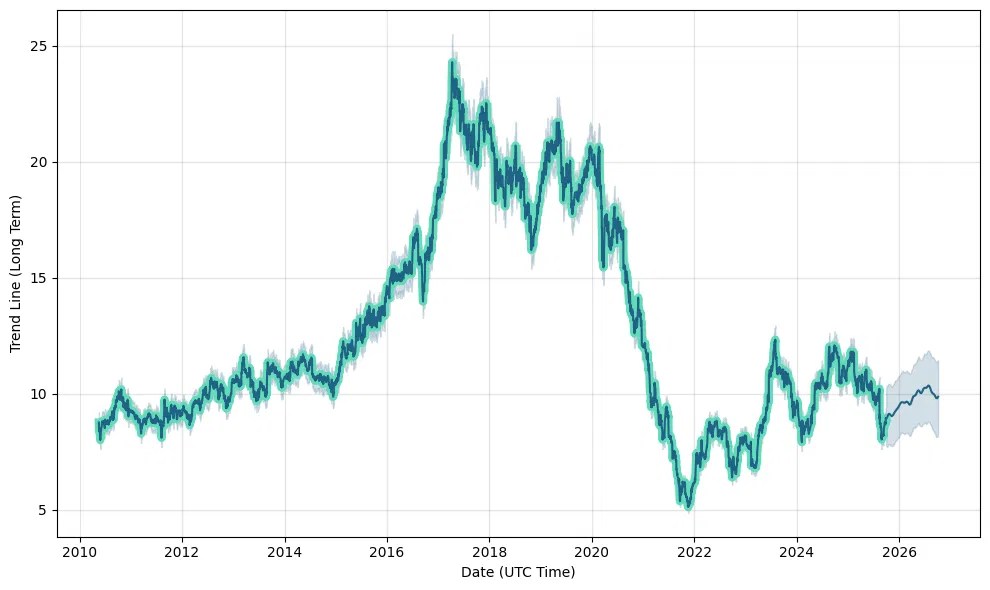

Historical Performance of AGL Share Price

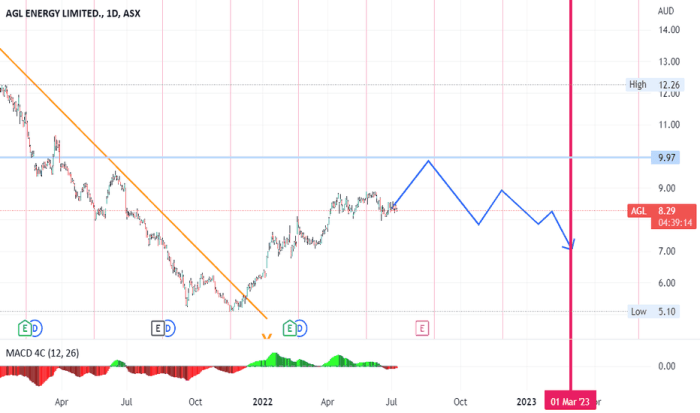

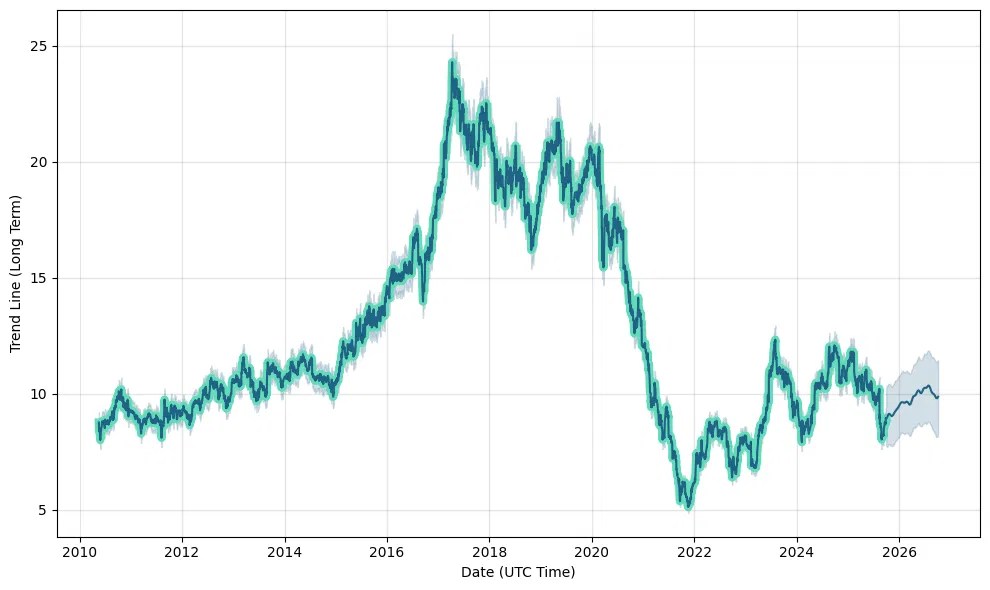

When analyzing the historical performance of AGL's share price, it is crucial to look back at past price fluctuations, compare them with industry benchmarks, and identify any patterns or trends that may have influenced AGL's share price history.AGL's share price has experienced various fluctuations over the years, influenced by factors such as market conditions, company performance, industry trends, and economic indicators.

By examining historical data, investors can gain valuable insights into how AGL's share price has evolved in response to different events and circumstances.

Comparison with Industry Benchmarks

One way to assess AGL's share price performance is by comparing it with industry benchmarks such as stock market indices or competitors' stock prices. This comparison can help investors understand how AGL's share price movement stacks up against broader market trends and industry peers.

- AGL's share price may have outperformed or underperformed industry benchmarks during specific time periods.

- Examining these comparisons can provide valuable context for evaluating AGL's historical performance and identifying potential investment opportunities or risks.

Analysis of Patterns and Trends

Analyzing historical data can also reveal patterns or trends in AGL's share price history, offering insights into potential future price movements. By identifying recurring patterns or trends, investors can make more informed decisions about buying, selling, or holding AGL's stock.

| Pattern/Trend | Implications |

|---|---|

| Seasonal Price Fluctuations | May indicate cyclical patterns influenced by seasonal factors or industry trends. |

| Long-Term Growth Trends | Can highlight AGL's historical growth trajectory and potential for future growth. |

Future Growth Prospects for AGL

As we look ahead to the future growth prospects for AGL, it's essential to consider the various opportunities and factors that could impact the company's share price.

Upcoming Renewable Energy Projects

AGL has been actively investing in renewable energy projects, such as wind and solar farms, to diversify its energy portfolio and reduce its carbon footprint. These projects could potentially lead to increased revenue streams and attract environmentally-conscious investors.

Expansion into Emerging Markets

AGL's plans to expand into emerging markets, both domestically and internationally, could open up new avenues for growth. By tapping into these markets, the company may be able to capture a larger market share and drive up its stock price.

Market Forecasts and AGL's Growth Trajectory

Market forecasts indicate a positive outlook for the energy sector, with increasing demand for renewable energy sources. AGL's strategic focus on sustainability and innovation aligns well with these forecasts, positioning the company for long-term growth and potentially higher share prices.

Risks and Challenges Facing AGL

As with any investment, AGL's share price is subject to various risks and challenges that could impact its performance in the market.

External Factors

External factors beyond AGL's control can pose risks to its share price. These may include economic conditions, political instability, and natural disasters that could affect the company's operations and financial performance.

Industry Challenges

- Increased competition from renewable energy sources may challenge AGL's traditional energy generation business model.

- Shifts in consumer preferences towards sustainable energy solutions could impact demand for AGL's products and services.

- Technological advancements in the energy sector may require significant investments by AGL to stay competitive.

Regulatory Changes and Competition

- Changes in government policies and regulations related to energy production and distribution could impact AGL's profitability.

- Intense competition from other energy companies could lead to pricing pressures and market share losses for AGL.

- Global trends towards decarbonization and environmental sustainability may require AGL to adapt its operations to meet regulatory requirements and consumer expectations.

Closing Notes

In conclusion, the outlook for the AGL share price is a multifaceted one, shaped by economic indicators, market trends, company performance, growth opportunities, risks, and challenges. By understanding these dynamics, investors can make informed decisions regarding their investments in AGL.

FAQ Explained

What are the key economic indicators affecting the AGL share price?

The key economic indicators include GDP growth, interest rates, inflation, and unemployment rates.

How does company performance influence the value of AGL shares?

Strong company performance, such as revenue growth and profitability, can lead to an increase in AGL share prices.

What are some risks that could impact the AGL share price?

Risks include regulatory changes, competition in the industry, and external economic factors affecting the energy sector.

What historical data should investors consider when analyzing AGL's share price?

Investors should look at past price fluctuations, industry benchmarks, and any patterns or trends in AGL's share price history.

Exploring the trajectory of the AGL share price in the long term, this discussion delves into the various factors influencing its movement, historical performance, future growth prospects, as well as the risks and challenges it faces. With a comprehensive analysis, readers can gain valuable insights into where the AGL share price may be headed.

Factors Influencing AGL Share Price

When it comes to the AGL share price, there are several key factors that can influence its movement in the market. These factors include economic indicators, market trends, and company performance.

Economic Indicators

Economic indicators play a crucial role in determining the direction of stock prices, including those of AGL. Factors such as interest rates, inflation rates, GDP growth, and employment numbers can all impact investor sentiment and ultimately affect the share price.

For example, if the economy is experiencing high inflation, investors may be more hesitant to invest in stocks like AGL, leading to a decrease in share price.

Market Trends

Market trends also have a significant impact on the share price of AGL. For instance, if there is a general uptrend in the stock market, AGL's share price is likely to be positively affected as well. Conversely, during a market downturn, AGL's share price may experience a decline due to overall market sentiment.

It is essential for investors to closely monitor market trends to anticipate potential movements in the share price of AGL.

Company Performance

The performance of AGL as a company is another critical factor that influences its share price. Factors such as revenue growth, profitability, market share, and strategic decisions made by the company's management can all impact investor confidence in AGL's stock.

Strong performance indicators can attract more investors, leading to an increase in share price, while poor performance may result in a decrease in share price as investors lose confidence in the company's ability to generate returns.

Historical Performance of AGL Share Price

When analyzing the historical performance of AGL's share price, it is crucial to look back at past price fluctuations, compare them with industry benchmarks, and identify any patterns or trends that may have influenced AGL's share price history.AGL's share price has experienced various fluctuations over the years, influenced by factors such as market conditions, company performance, industry trends, and economic indicators.

By examining historical data, investors can gain valuable insights into how AGL's share price has evolved in response to different events and circumstances.

Comparison with Industry Benchmarks

One way to assess AGL's share price performance is by comparing it with industry benchmarks such as stock market indices or competitors' stock prices. This comparison can help investors understand how AGL's share price movement stacks up against broader market trends and industry peers.

- AGL's share price may have outperformed or underperformed industry benchmarks during specific time periods.

- Examining these comparisons can provide valuable context for evaluating AGL's historical performance and identifying potential investment opportunities or risks.

Analysis of Patterns and Trends

Analyzing historical data can also reveal patterns or trends in AGL's share price history, offering insights into potential future price movements. By identifying recurring patterns or trends, investors can make more informed decisions about buying, selling, or holding AGL's stock.

| Pattern/Trend | Implications |

|---|---|

| Seasonal Price Fluctuations | May indicate cyclical patterns influenced by seasonal factors or industry trends. |

| Long-Term Growth Trends | Can highlight AGL's historical growth trajectory and potential for future growth. |

Future Growth Prospects for AGL

As we look ahead to the future growth prospects for AGL, it's essential to consider the various opportunities and factors that could impact the company's share price.

Upcoming Renewable Energy Projects

AGL has been actively investing in renewable energy projects, such as wind and solar farms, to diversify its energy portfolio and reduce its carbon footprint. These projects could potentially lead to increased revenue streams and attract environmentally-conscious investors.

Expansion into Emerging Markets

AGL's plans to expand into emerging markets, both domestically and internationally, could open up new avenues for growth. By tapping into these markets, the company may be able to capture a larger market share and drive up its stock price.

Market Forecasts and AGL's Growth Trajectory

Market forecasts indicate a positive outlook for the energy sector, with increasing demand for renewable energy sources. AGL's strategic focus on sustainability and innovation aligns well with these forecasts, positioning the company for long-term growth and potentially higher share prices.

Risks and Challenges Facing AGL

As with any investment, AGL's share price is subject to various risks and challenges that could impact its performance in the market.

External Factors

External factors beyond AGL's control can pose risks to its share price. These may include economic conditions, political instability, and natural disasters that could affect the company's operations and financial performance.

Industry Challenges

- Increased competition from renewable energy sources may challenge AGL's traditional energy generation business model.

- Shifts in consumer preferences towards sustainable energy solutions could impact demand for AGL's products and services.

- Technological advancements in the energy sector may require significant investments by AGL to stay competitive.

Regulatory Changes and Competition

- Changes in government policies and regulations related to energy production and distribution could impact AGL's profitability.

- Intense competition from other energy companies could lead to pricing pressures and market share losses for AGL.

- Global trends towards decarbonization and environmental sustainability may require AGL to adapt its operations to meet regulatory requirements and consumer expectations.

Closing Notes

In conclusion, the outlook for the AGL share price is a multifaceted one, shaped by economic indicators, market trends, company performance, growth opportunities, risks, and challenges. By understanding these dynamics, investors can make informed decisions regarding their investments in AGL.

FAQ Explained

What are the key economic indicators affecting the AGL share price?

The key economic indicators include GDP growth, interest rates, inflation, and unemployment rates.

How does company performance influence the value of AGL shares?

Strong company performance, such as revenue growth and profitability, can lead to an increase in AGL share prices.

What are some risks that could impact the AGL share price?

Risks include regulatory changes, competition in the industry, and external economic factors affecting the energy sector.

What historical data should investors consider when analyzing AGL's share price?

Investors should look at past price fluctuations, industry benchmarks, and any patterns or trends in AGL's share price history.