Kicking off with Pros and Cons of Revenue Based Financing for Startups, this opening paragraph is designed to captivate and engage the readers, setting the tone casual formal language style that unfolds with each word.

Revenue-based financing offers a unique approach for startups to secure funding based on their existing revenue streams. In this discussion, we will explore the advantages and disadvantages of this alternative financing method compared to traditional options.

Overview of Revenue-Based Financing

Revenue-based financing is a funding model where a startup receives capital in exchange for a percentage of future revenues. Unlike traditional funding methods like equity financing or debt financing, revenue-based financing does not involve giving up ownership or taking on debt.

Main Characteristics of Revenue-Based Financing for Startups

- Repayment Structure: Startups repay the funding through a percentage of their monthly revenue until a predetermined amount is reached. This means that payments fluctuate based on the company's revenue performance.

- No Equity Dilution: Unlike equity financing, revenue-based financing allows startups to retain full ownership and control of their company. Investors receive a share of revenue but do not have ownership rights.

- Risk-sharing: Investors in revenue-based financing share the risk with the startup. If the company does not perform well, investors may not recoup their investment, making it a more collaborative funding model.

- Growth-oriented: Revenue-based financing is suitable for startups looking to scale quickly without the pressure of immediate profitability. It provides the necessary capital for growth without the need to focus solely on short-term returns.

Pros of Revenue-Based Financing

Revenue-based financing offers several advantages for startups compared to traditional loans. One of the key benefits is the flexibility it provides in terms of repayment, which is directly tied to the company's revenue. This means that startups do not face the pressure of fixed monthly payments, making it easier to manage cash flow.

Enhanced Cash Flow Management

Revenue-based financing can help startups better manage their cash flow by allowing for more flexibility in repayment. Since payments are based on a percentage of revenue, startups can align their repayment schedule with their cash flow, making it easier to navigate through periods of fluctuating revenue.

Flexible Repayment Structure

Unlike traditional loans with fixed monthly payments, revenue-based financing offers a more adaptable repayment structure. Startups only need to make payments when they generate revenue, providing them with breathing room during slower months. This flexibility can be crucial for startups that may experience seasonal fluctuations or unexpected challenges.

No Equity Dilution

Another advantage of revenue-based financing is that it does not require giving up equity in the company. Startups can maintain full ownership and control of their business while still accessing the funding they need to grow. This can be especially appealing for founders who want to retain ownership over their vision.

Quick Access to Capital

Revenue-based financing typically involves a faster approval process compared to traditional loans, allowing startups to access capital more quickly when needed. This speed can be crucial for seizing opportunities or addressing urgent financial needs without going through lengthy approval procedures.

Cons of Revenue-Based Financing

Revenue-based financing, while beneficial in many ways, also comes with its own set of drawbacks that startups need to consider before opting for this funding option. These cons can impact the long-term growth and equity ownership of the startup.

1. Repayment Structure

Revenue-based financing requires startups to repay a fixed percentage of their revenue until a predetermined amount is repaid. This can put a strain on cash flow, especially during periods of slow growth or economic downturns.

2. Impact on Equity

Unlike traditional equity financing, revenue-based financing does not involve giving up ownership stakes in the company. However, the continuous revenue sharing can lead to a situation where the startup ends up paying back significantly more than the initial investment, impacting the overall equity ownership of the founders.

3. Limited Capital Injection

Since revenue-based financing is tied to the company's revenue, the amount of capital that can be injected into the business is limited by its income. This can restrict the ability of startups to scale quickly or take advantage of growth opportunities that require substantial upfront investment.

4. Lack of Investor Expertise

In revenue-based financing, investors are primarily interested in the financial returns based on revenue sharing rather than actively participating in the management and growth of the startup. This lack of expertise and guidance from investors can be a disadvantage for startups looking for more than just funding.

5. Potential Conflict of Interest

The repayment structure of revenue-based financing can create a conflict of interest between the investors and the startup founders. Investors may push for short-term gains to maximize their returns, while founders might have a long-term vision for the company's growth and development.

6. Risk of Default

If the startup fails to generate the projected revenue, it may struggle to meet the repayment obligations of revenue-based financing. This could lead to defaulting on the agreement, damaging the relationship with investors and impacting the company's creditworthiness.

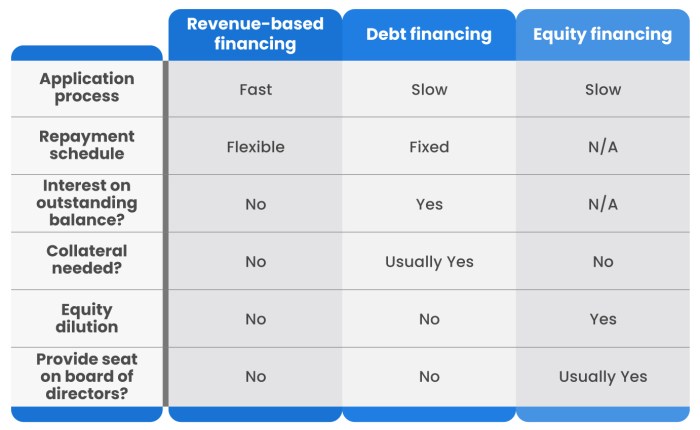

Comparison with Other Funding Options

Revenue-based financing offers a unique alternative to traditional funding options like venture capital and bank loans, catering to different needs of startups in the early stages of growth. Let's delve into how revenue-based financing compares to these options and its suitability for various types of startups.

Comparison with Venture Capital and Bank Loans

When comparing revenue-based financing with venture capital and bank loans, it's essential to consider the trade-offs that each option presents. Venture capital typically involves giving up equity in exchange for funding, while bank loans require collateral and fixed repayments.

- Venture Capital:Venture capital can provide startups with a significant amount of capital upfront but often comes with high expectations for growth and a loss of control over the business.

- Bank Loans:Bank loans require startups to have a strong credit history and collateral, making them less accessible to early-stage companies. Additionally, fixed monthly payments may strain cash flow in the early stages.

- Revenue-Based Financing:Revenue-based financing offers flexible repayments based on a percentage of monthly revenue, aligning the interests of the investor with the success of the business. Startups retain control and ownership without diluting equity.

Suitability for Different Types of Startups

Revenue-based financing is well-suited for startups with consistent revenue streams looking for growth capital without giving up equity or collateral. It is particularly attractive for SaaS companies, e-commerce businesses, and other subscription-based models with predictable revenue.

- SaaS Companies:Revenue-based financing can be ideal for SaaS companies with steady monthly recurring revenue, allowing them to invest in growth without sacrificing ownership.

- E-commerce Businesses:E-commerce startups can benefit from revenue-based financing to scale their operations and inventory without the need for physical collateral.

- Subscription-Based Models:Startups with subscription-based models can leverage revenue-based financing to fund customer acquisition and retention strategies.

Complementing or Competing with Other Funding Sources

Revenue-based financing can complement traditional funding sources like venture capital or angel investors by providing additional capital without diluting equity. It can also serve as a bridge between early-stage funding and more traditional debt financing options like bank loans.

By diversifying funding sources, startups can reduce risk and maintain flexibility in their capital structure, adapting to changing market conditions and growth opportunities.

Outcome Summary

As we come to the end of our exploration into the Pros and Cons of Revenue Based Financing for Startups, it's clear that this funding method presents a mixed bag of benefits and challenges. Understanding these nuances is crucial for startups looking to make informed decisions about their financial future.

Expert Answers

How does revenue-based financing differ from traditional loans?

Revenue-based financing does not require fixed monthly payments and instead takes a percentage of the startup's revenue until a predetermined amount is repaid.

What are the potential challenges faced by startups when opting for revenue-based financing?

Startups may face higher overall costs due to the revenue-sharing model and potential constraints on future financing options.

How does revenue-based financing complement or compete with other funding sources?

Revenue-based financing offers flexibility and aligns the interests of investors and startups, making it a viable alternative to traditional loans or venture capital funding.