Exploring the comparison between Revenue Based Financing and Venture Capital, this introduction sets the stage for an insightful discussion on the ideal funding choice for businesses, using a blend of engaging language and informative content.

The following paragraph will delve into the definitions and key disparities between these two financing methods.

Revenue Based Financing vs Venture Capital

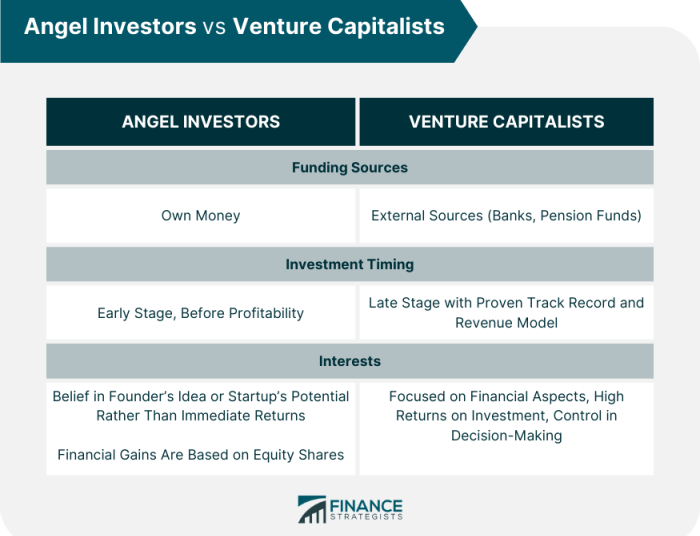

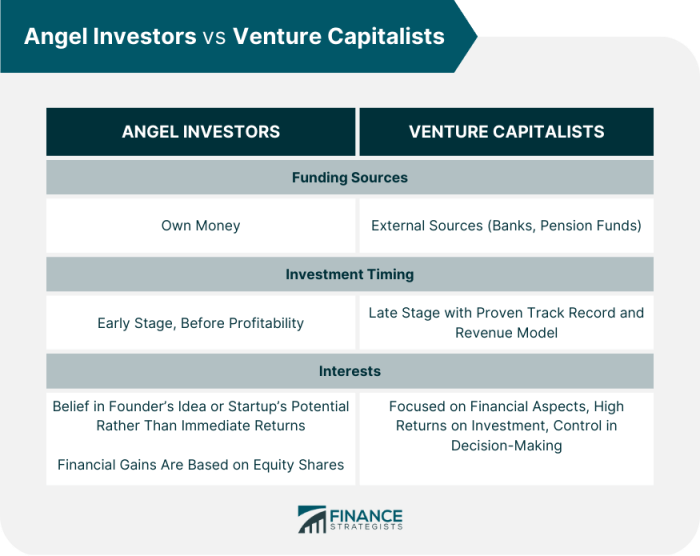

Revenue Based Financing (RBF) is a form of funding where a company receives capital in exchange for a percentage of future revenues. On the other hand, Venture Capital involves investors providing funds to startups or small businesses in exchange for equity ownership.The key difference between Revenue Based Financing and Venture Capital lies in the way the funding is structured.

RBF focuses on a share of the company's revenue, while Venture Capital investors take an ownership stake in the business.Companies like Clearbanc and Lighter Capital have utilized Revenue Based Financing to scale their operations without giving up equity. In contrast, startups such as Uber and Airbnb have raised significant amounts of funding through Venture Capital investments to fuel their growth.

Examples of Revenue Based Financing and Venture Capital

- Revenue Based Financing:

- Clearbanc: Clearbanc offers RBF to e-commerce businesses looking to scale their marketing efforts without diluting ownership.

- Lighter Capital: Lighter Capital provides Revenue Based Financing to tech startups in need of growth capital without giving up control.

- Venture Capital:

- Uber: Uber raised substantial funding through Venture Capital to expand its ride-sharing platform globally.

- Airbnb: Airbnb secured significant investments from Venture Capital firms to grow its online marketplace for lodging and tourism experiences.

Pros and Cons of Revenue Based Financing

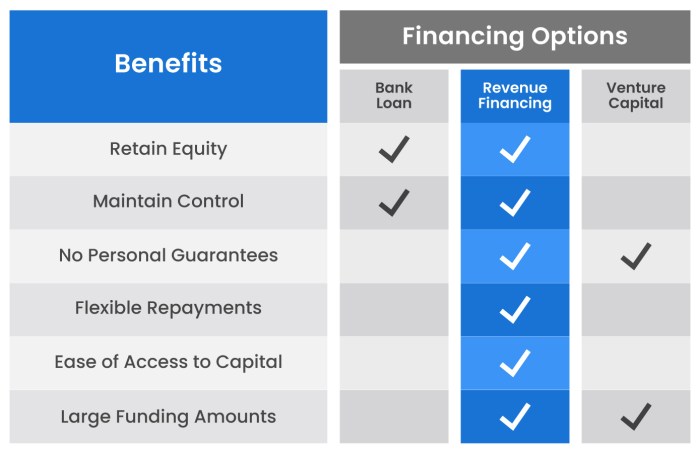

Revenue Based Financing (RBF) offers a unique funding option for startups that differs from traditional loans and venture capital investments. Let's explore the advantages and limitations associated with this innovative financing model.

Advantages of Revenue Based Financing for Startups

- Flexible Repayment: RBF allows startups to repay the investment based on a percentage of their revenue, which provides flexibility during times of fluctuating cash flow.

- No Equity Dilution: Unlike venture capital, RBF does not require giving up ownership stakes in the company, allowing founders to retain control and future profits.

- Quick Access to Capital: RBF offers a faster approval process compared to traditional loans, making it an attractive option for startups in need of immediate funds.

- Growth Support: Investors in RBF are incentivized to help the company grow since their return is directly tied to the startup's revenue, aligning their interests with the founders.

Limitations of Revenue Based Financing

- Higher Cost: RBF typically has a higher cost of capital compared to traditional loans, as investors take on more risk by not requiring collateral.

- Revenue Sharing: Startups need to share a percentage of their revenue with RBF investors, which can impact profitability and cash flow in the long run.

- Restrictions on Growth: The repayment structure of RBF may limit a startup's ability to reinvest profits back into the business for rapid expansion, as a portion of revenue is allocated towards repayment.

Flexibility of Revenue Based Financing vs Traditional Loans

- Flexible Terms: RBF offers more flexible repayment terms based on revenue performance, while traditional loans often come with fixed monthly payments regardless of cash flow.

- No Personal Guarantees: RBF does not require personal guarantees from founders, unlike traditional loans that may put personal assets at risk in case of default.

- Growth Alignment: RBF investors are aligned with the startup's growth objectives, as their returns are directly tied to the company's revenue growth, fostering a collaborative relationship.

Pros and Cons of Venture Capital

Venture capital funding can provide significant benefits to entrepreneurs looking to scale their business rapidly. However, there are also potential drawbacks and risks that need to be carefully considered before opting for this type of financing

Benefits of Venture Capital Funding for Entrepreneurs

- Access to significant capital: Venture capital firms can provide large sums of money to fuel rapid growth and expansion.

- Expertise and network: Venture capitalists often bring valuable industry knowledge, experience, and connections to help guide the business towards success.

- Growth acceleration: With the infusion of venture capital, startups can accelerate their growth trajectory and reach milestones more quickly.

- Validation and credibility: Securing funding from reputable venture capital firms can validate the business model and provide credibility in the market.

Potential Drawbacks or Risks Involved in Securing Venture Capital

- Dilution of ownership: Venture capital funding usually involves giving up a portion of equity in the company, which can lead to a loss of control for the founders.

- Pressure for rapid growth: Venture capitalists often have high expectations for returns on their investment, putting pressure on the entrepreneurs to achieve rapid growth and profitability.

- Loss of decision-making autonomy: Venture capitalists may have a say in major business decisions, potentially limiting the founders' autonomy in running the company.

- Exit expectations: Venture capital firms typically expect an exit event, such as an acquisition or IPO, within a specific timeframe, which can create additional stress and constraints on the founders.

Level of Control Retained by Founders When Opting for Venture Capital

- While founders may initially have control over the operations and direction of the company, accepting venture capital funding can lead to a loss of control as investors become more involved in decision-making processes.

- Founders need to strike a balance between leveraging the expertise and resources of venture capitalists while retaining enough control to steer the company towards their vision.

Criteria for Choosing Between Revenue Based Financing and Venture Capital

Deciding between Revenue Based Financing and Venture Capital can be a critical choice for startups. To make an informed decision, it is essential to consider various criteria that can impact the suitability of each funding option. Factors such as business stage, growth projections, and industry dynamics play a significant role in determining which financing route aligns best with the startup's goals and long-term sustainability.

Business Stage

- Early-stage startups with limited revenue streams may find Venture Capital more appealing, as it provides substantial capital injections to fuel rapid growth and scale operations.

- Established businesses with steady revenue but seeking additional capital for expansion may benefit more from Revenue Based Financing, as it offers flexible repayment structures based on revenue performance.

Growth Projections

- Startups with aggressive growth projections and a focus on market domination might prefer Venture Capital, as it allows for significant capital infusion to support rapid scaling initiatives and market expansion.

- On the other hand, startups with conservative growth projections and a desire to maintain control over their business may opt for Revenue Based Financing, which offers a less dilutive funding option with a focus on revenue-sharing agreements.

Industry Impact

- Certain industries with high growth potential and scalability, such as technology and healthcare, are more aligned with Venture Capital funding due to the need for substantial capital investment to drive innovation and market disruption.

- Industries with stable revenue streams and predictable cash flows, such as manufacturing or services, may find Revenue Based Financing more suitable, as it provides a financing model that aligns with revenue generation capabilities.

Long-term Implications

- Choosing Venture Capital can lead to significant equity dilution and influence on decision-making processes, as VCs often seek a high return on investment and active involvement in the company's strategic direction.

- Opting for Revenue Based Financing may result in slower growth compared to Venture Capital, but it offers more control over the business and less equity dilution, allowing founders to maintain ownership and decision-making autonomy.

Closure

Concluding our exploration, this section offers a compelling summary of the debate between Revenue Based Financing and Venture Capital, leaving readers with a clear understanding of the pros and cons of each approach.

FAQ Guide

Which funding option is more suitable for early-stage startups?

Revenue Based Financing may be more beneficial for early-stage startups looking to maintain control and avoid equity dilution.

What are some examples of successful companies that have utilized Venture Capital?

Companies like Uber, Airbnb, and Facebook have all received significant Venture Capital funding to fuel their growth.

How does Revenue Based Financing compare to traditional loans in terms of flexibility?

Revenue Based Financing typically offers more flexibility than traditional loans as repayments are tied to revenue.