Understanding debt financing is crucial for businesses looking to grow and thrive in today's competitive market. This comprehensive guide delves into the intricacies of debt financing, shedding light on its significance and impact on business operations.

As we navigate through the nuances of debt financing, we uncover valuable insights that can steer businesses towards making informed financial decisions for sustainable growth.

Introduction to Debt Financing

Debt financing is a common practice for businesses to raise capital by borrowing money from external sources. This allows businesses to fund operations, expansions, or other financial needs without giving up ownership stakes.

Debt financing differs from equity financing in that businesses taking on debt are obligated to repay the borrowed amount plus interest over a specified period. On the other hand, equity financing involves selling ownership shares in the company in exchange for funding, without the obligation of repayment.

Common Types of Debt Financing Options

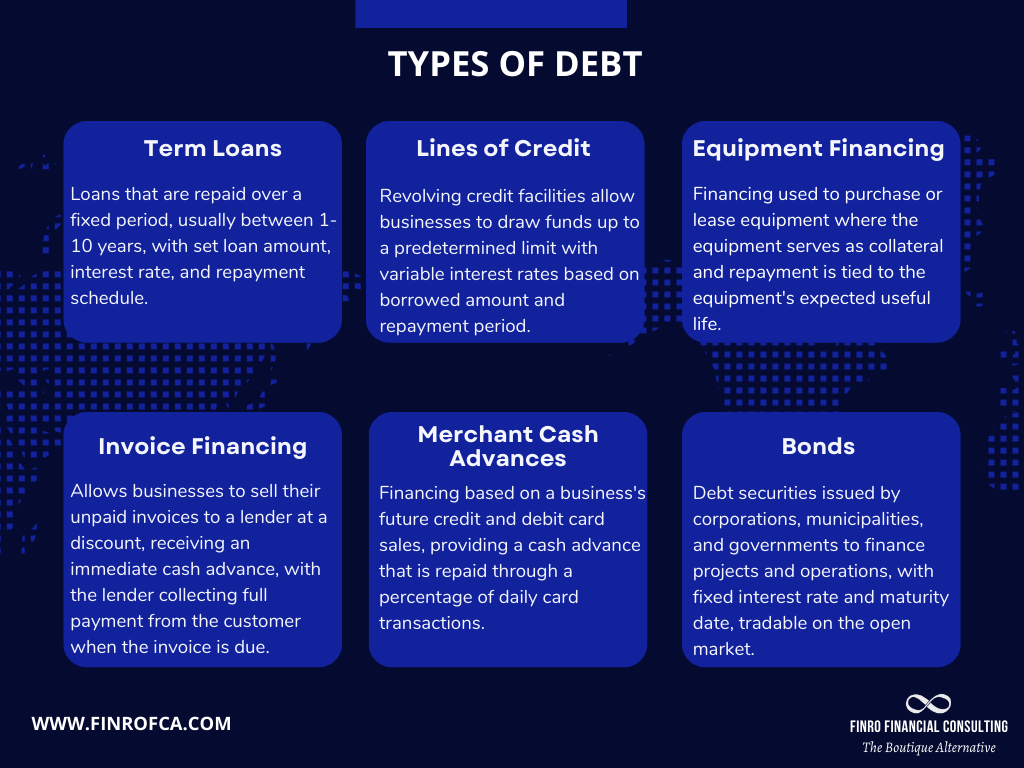

- Bank Loans: Businesses can secure loans from banks with fixed repayment schedules and interest rates.

- Corporate Bonds: Companies can issue bonds to investors, promising to repay the principal amount plus interest at a future date.

- Lines of Credit: Businesses can establish lines of credit with financial institutions, allowing them to borrow funds up to a certain limit when needed.

- Asset-Based Financing: This type of debt financing involves using company assets as collateral to secure a loan.

Advantages of Debt Financing

Debt financing offers several advantages for businesses looking to secure funding for their operations and growth. It provides a way for businesses to access a large sum of money upfront without giving up ownership or control of the company.

Benefits of Using Debt Financing

- Immediate access to capital: Debt financing allows businesses to quickly obtain the funds they need to invest in new equipment, expand operations, or cover unexpected expenses.

- Lower cost compared to equity: Debt financing typically comes with lower costs than equity financing since businesses only need to repay the loan amount plus interest, without giving away ownership shares.

- Tax benefits: Interest payments on debt financing are usually tax-deductible, which can help reduce the overall tax liability for the business.

Help with Cash Flow Management

- Fixed repayment schedule: With debt financing, businesses have a predetermined repayment schedule, making it easier to budget and plan for future expenses.

- Stable cash flow: By taking out a loan, businesses can maintain a stable cash flow even during slow periods or when facing unexpected costs.

- Flexibility in repayment terms: Lenders often offer flexible repayment terms, allowing businesses to choose a schedule that aligns with their cash flow projections.

Comparison to Other Forms of Financing

- Retain ownership: Unlike equity financing, debt financing allows businesses to retain full ownership and control of the company.

- Fixed costs: Debt financing comes with fixed interest rates, making it easier for businesses to predict and manage their financial obligations.

- Less dilution: Since debt financing does not involve selling ownership stakes, there is no dilution of ownership for existing shareholders.

Disadvantages of Debt Financing

While debt financing can provide businesses with essential funds, there are several potential drawbacks that need to be considered.

One of the main risks associated with debt financing is the obligation to repay the borrowed amount along with interest. If a business is unable to generate enough revenue to cover the debt payments, it can lead to financial strain and even bankruptcy.

Increased Financial Risk

When a business takes on debt, it increases its financial risk. The business is now obligated to make regular payments, regardless of its cash flow situation. If the business encounters financial difficulties, it may struggle to meet its debt obligations, leading to potential default.

High Interest Costs

Debt financing typically comes with interest costs, which can add up over time. High interest rates can significantly increase the overall cost of borrowing, affecting the profitability of the business. In cases where interest rates rise unexpectedly, the debt burden can become even more challenging to manage.

Loss of Control

When a business relies heavily on debt financing, it may have to give up a certain degree of control. Lenders often impose restrictions on how the borrowed funds can be used and may require regular financial reporting. Additionally, in extreme cases, lenders may have the power to take control of the business if debt obligations are not met.

Limited Future Borrowing Capacity

Excessive debt levels can limit a business's ability to secure additional financing in the future. Lenders may be hesitant to extend credit to a business with high existing debt levels, as it raises concerns about the business's ability to manage its financial obligations.

This can restrict the business's growth opportunities and financial flexibility.

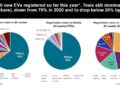

Types of Debt Financing

Debt financing comes in various forms, each serving different purposes for businesses. Let's explore some common types:

Term Loans

Term loans are a popular form of debt financing where a specific amount is borrowed for a fixed period at a predetermined interest rate. These loans are commonly used for large investments or long-term projects.

Lines of Credit

A line of credit is a flexible form of debt financing where a lender provides a maximum borrowing amount that can be drawn upon as needed. Businesses often use lines of credit to manage cash flow fluctuations or fund short-term expenses.

Bonds

Bonds are debt securities issued by companies to raise capital. Investors purchase bonds, which represent a loan to the issuing company. Bonds typically have a fixed interest rate and maturity date, making them a common choice for businesses looking to raise funds for specific projects or expansions.

Steps to Secure Debt Financing

Securing debt financing is an important step for many businesses looking to grow or expand. Here are the typical steps and key considerations to keep in mind:

Research and Planning

Before pursuing debt financing, businesses need to conduct thorough research and planning. This includes assessing their current financial situation, determining how much funding is needed, and researching potential lenders.

Choose the Right Type of Debt Financing

Businesses should consider the different types of debt financing available and choose the option that best fits their needs. This could be in the form of traditional bank loans, lines of credit, or alternative lenders.

Prepare a Detailed Business Plan

A detailed business plan is essential when applying for debt financing. This plan should Artikel the business's financial projections, growth strategy, and how the funds will be used.

Gather Necessary Documentation

Businesses will need to gather various financial documents, such as tax returns, financial statements, and business licenses, to support their loan application. Having these documents organized and ready can streamline the application process.

Submit Loan Application

Once all the necessary preparation is done, businesses can submit their loan application to the chosen lender. It's important to be transparent and provide accurate information to increase the chances of approval.

Follow Up and Negotiate Terms

After submitting the application, it's important to follow up with the lender and be prepared to negotiate loan terms if needed. Businesses should carefully review the terms and conditions before accepting any offer.

Impact of Debt Financing on Businesses

Debt financing can have a significant impact on a business's financial health and stability. While it can provide the necessary funds for growth and expansion, it also comes with implications that can affect the overall operations of a company.

Financial Health and Stability

- Debt financing can increase a company's financial leverage, allowing it to invest in new projects or equipment that can lead to growth.

- However, excessive debt can strain a company's cash flow, leading to financial instability and potential bankruptcy if not managed properly.

- High levels of debt can also impact a company's credit rating, making it more difficult and expensive to secure future financing.

Business Operations and Growth

- Debt financing can provide the necessary capital for business expansion, such as opening new locations or launching new products/services.

- However, the interest payments and principal repayments associated with debt can eat into a company's profits, limiting its ability to reinvest in the business.

- In some cases, businesses may become too reliant on debt financing, leading to a cycle of borrowing to cover existing debt, which can hinder long-term growth.

Examples of Debt Financing Impact

- Company A took on significant debt to fund a major expansion project, which ultimately paid off with increased revenue and market share.

- On the other hand, Company B struggled to repay its debt obligations due to a downturn in the market, leading to financial distress and eventual bankruptcy.

- Company C maintained a healthy balance of debt and equity financing, allowing it to leverage debt for growth while managing the associated risks effectively.

Debt Financing vs. Equity Financing

When it comes to funding a business, two common options are debt financing and equity financing. Debt financing involves borrowing money that must be repaid with interest, while equity financing involves selling a stake in the business in exchange for funds.

Let's compare and contrast these two methods of financing to understand their key differences.

Ownership

In debt financing, the business retains full ownership as the borrowed funds do not dilute the ownership stake of the existing owners. On the other hand, equity financing involves giving up a portion of ownership to investors in exchange for capital.

Repayment

Debt financing requires regular repayment of the borrowed amount along with interest, which can put a strain on the cash flow of the business. In contrast, equity financing does not require repayment since investors become shareholders and share in the profits of the business.

Risk

Debt financing carries the risk of default if the business is unable to make the required payments, which can lead to legal consequences such as asset seizure. Equity financing, on the other hand, shifts some of the risk to the investors who may lose their investment if the business does not perform well.

Preference of Debt vs. Equity Financing

Debt financing may be preferred over equity financing when the business wants to retain full ownership and control, or when the founders are confident in their ability to repay the borrowed amount. On the other hand, equity financing may be a better option when the business is in its early stages and does not have a steady cash flow to support debt repayment, or when the founders are open to sharing ownership and decision-making with investors.

Ending Remarks

In conclusion, mastering the concept of debt financing equips businesses with the tools needed to navigate the complex landscape of financial management. By understanding the advantages, disadvantages, and types of debt financing, businesses can strategically leverage this financial tool to propel their success.

FAQ Overview

What are the key differences between debt financing and equity financing?

Debt financing involves borrowing funds that need to be repaid with interest, while equity financing entails selling ownership in the business in exchange for capital.

What are some common types of debt financing options available to businesses?

Common types include term loans, lines of credit, and bonds, each offering different structures and repayment terms.

How does debt financing impact a business's financial health?

Debt financing can provide a boost to cash flow but also increase financial risk due to repayment obligations and interest costs.

When might debt financing not be the best option for a business?

Debt financing may not be ideal for businesses with unstable cash flow or those unable to manage the associated risks effectively.