Exploring the factors influencing Ford's share price in 2025 opens up a world of economic indicators, technological innovations, the competitive landscape, and the regulatory environment. This in-depth analysis delves into the intricacies of what will shape Ford's stock performance in the coming years.

Factors influencing Ford Share Price

Investors and analysts closely monitor various factors that influence Ford's share price, ranging from economic conditions to company performance.

Key Economic Indicators Impacting Ford's Stock Price

Economic indicators such as GDP growth, inflation rates, and interest rates can significantly impact Ford's stock price. For instance, a strong GDP growth often indicates higher consumer spending and demand for vehicles, leading to a potential increase in Ford's stock price.

On the other hand, high inflation rates or interest rates can negatively affect consumer purchasing power and overall demand for vehicles, which may result in a decline in Ford's share price.

Global Events like Trade Agreements

Global events like trade agreements can also influence Ford's share price. Trade agreements that reduce tariffs and trade barriers can benefit Ford by increasing its access to international markets and potentially boosting sales. Conversely, trade disputes or tariffs imposed on automotive imports could negatively impact Ford's profitability and stock price.

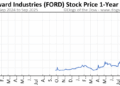

Ford's Financial Performance

Ford's financial performance, including factors like revenue growth, profit margins, and cash flow, plays a crucial role in determining its share price. Strong financial results, such as increased revenue or improved profitability, are typically viewed positively by investors and can lead to an uptick in Ford's stock price.

Conversely, disappointing financial performance or missed targets may result in a decline in Ford's share price.

Technological Innovations

Investing in technological advancements has become crucial for Ford to stay competitive in the rapidly evolving automotive industry. Let's delve into how these innovations impact Ford's stock price and market value.

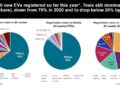

Electric Vehicles

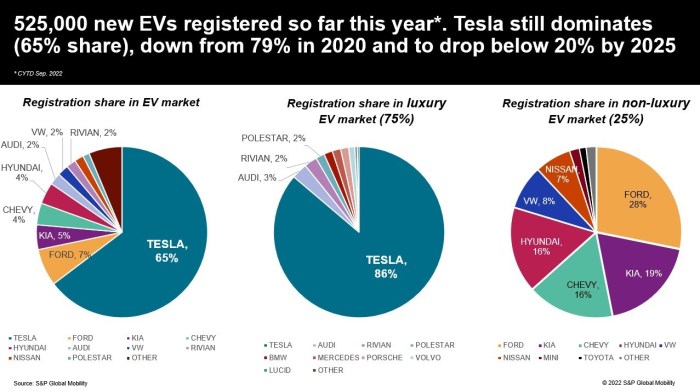

- Ford's commitment to electric vehicles, like the Mustang Mach-E and F-150 Lightning, has generated significant investor interest. The shift towards electric vehicles aligns with the global trend towards sustainability and reduced carbon emissions.

- As Ford continues to expand its electric vehicle lineup and invest in battery technology, investors view the company as well-positioned for future growth in the electric vehicle market. This positive sentiment can drive up Ford's share price.

Autonomous Driving Technology

- Advancements in autonomous driving technology, such as Ford's partnership with Argo AI, have the potential to revolutionize the transportation industry. The development of self-driving vehicles could enhance safety, efficiency, and convenience.

- Investors closely monitor Ford's progress in autonomous driving technology, as successful implementation could lead to new revenue streams and increased market share. Positive developments in this area can boost Ford's market value.

Innovation Strategy

- Ford's overall innovation strategy, including investments in connected vehicles and smart mobility solutions, plays a critical role in shaping investor sentiment. The ability to adapt to changing consumer preferences and technological advancements is key for long-term success.

- By demonstrating a commitment to innovation and technological progress, Ford can attract investors looking for growth opportunities in the automotive sector. A forward-thinking approach to innovation can positively impact Ford's share price.

Competitive Landscape

In the automotive industry, Ford faces stiff competition from key competitors that can influence its stock performance.

Comparison of Stock Performance

- Ford's stock performance can be compared with major competitors like General Motors, Toyota, and Volkswagen to assess its relative strength in the market.

- Understanding how Ford's stock price movement compares to these competitors can provide valuable insights into the overall health of the company.

Market Share Trends Impact

- Analyzing market share trends in the automotive industry can help predict Ford's future share price movements.

- Changes in market share, either gains or losses, can significantly impact investor sentiment towards Ford and its stock valuation.

Competitive Pricing Strategies

- Examining how competitive pricing strategies of Ford and its rivals affect consumer demand and overall sales can shed light on stock valuation.

- Competing on price in a crowded market can influence Ford's ability to maintain profitability and sustain investor confidence.

Regulatory Environment

Government regulations play a crucial role in shaping the automotive industry, impacting companies like Ford. Let's delve into how regulatory changes can influence Ford's share price.

Impact of Emissions and Safety Standards

- Government regulations on emissions and safety standards can significantly impact Ford's share price. Stricter regulations may require Ford to invest in new technologies or modify existing ones to comply, leading to increased production costs.

- Failure to meet these regulations could result in fines and penalties, affecting Ford's profitability and investor confidence.

- On the other hand, proactive compliance with emissions and safety standards can enhance Ford's reputation and appeal to socially responsible investors, positively influencing its share price.

Cost of Compliance and Profitability

- Changes in regulatory requirements can increase Ford's production costs as the company invests in research and development to meet new standards.

- Higher compliance costs may impact Ford's profitability, especially if these costs cannot be passed on to consumers through higher prices.

- Investors closely monitor how Ford manages these costs and the overall impact on the company's financial performance, which can influence the stock price.

Investor Confidence and Share Price

- Ford's commitment to environmental policies and regulatory compliance can influence investor confidence. Companies that demonstrate responsible practices are often viewed more favorably by investors.

- Positive perceptions of Ford's environmental and safety initiatives can lead to increased demand for its shares, potentially driving up the stock price.

- Conversely, any negative publicity related to regulatory violations or non-compliance can have a detrimental effect on investor sentiment and Ford's share price.

Final Thoughts

In conclusion, the dynamics of Ford's share price in 2025 are driven by a complex interplay of various factors, making it a compelling investment opportunity worth monitoring closely. Stay informed and stay ahead in the ever-evolving world of Ford's stock market performance.

General Inquiries

What factors will influence Ford's share price the most in 2025?

The factors that are likely to have the most significant impact on Ford's share price in 2025 include its financial performance, global events, technological innovations, competitive landscape, and regulatory environment.

How do government regulations affect Ford's stock price?

Government regulations on emissions and safety standards can influence Ford's share price by impacting production costs, profitability, and investor confidence based on the company's compliance with such policies.

What role does innovation play in determining Ford's share price?

Ford's innovation strategy, particularly in areas like electric vehicles and autonomous driving technology, can significantly affect investor sentiment and ultimately impact the company's stock valuation.

How does Ford's stock performance compare to its competitors in the automotive industry?

Comparing Ford's stock performance with key competitors and analyzing market share trends can provide insights into how competitive pricing strategies and market dynamics influence Ford's share price.